Market Highlight 29.08.2024

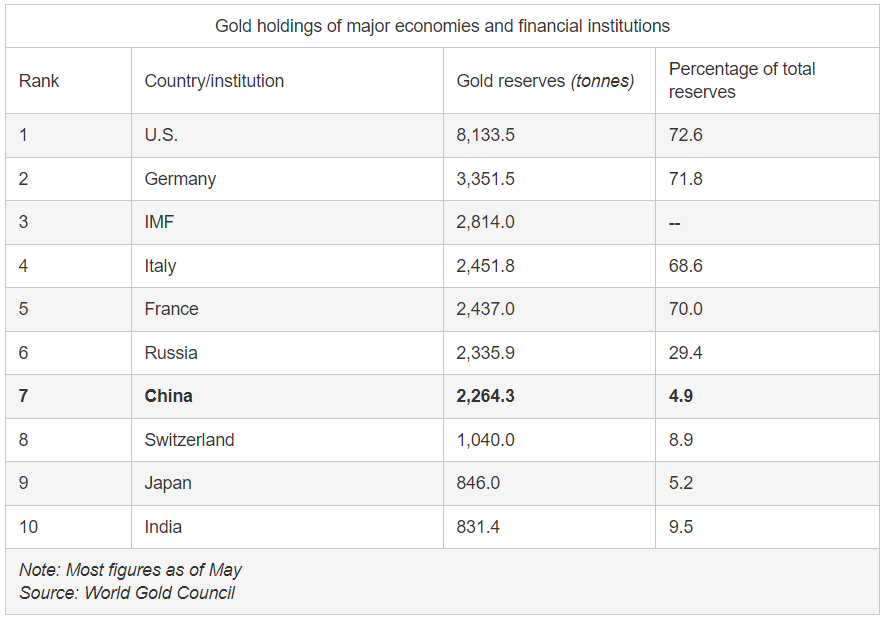

Gold’s appeal shows no signs of cooling, even as prices continue to set new all-time highs. In addition to its role as a safe-haven asset amid global geopolitical tensions, the rise in gold prices has been supported by expectations of interest rate cuts in the U.S, robust reserve accumulation by central banks, and more recently, tax policy changes in India. The influence of the Chinese market - the world’s largest consumer of bullion - is waning. However, since July, India has introduced policies to reduce import duties on gold from 15% to 6%, while income tax on gold transactions has also been lowered from 20% to 12,5%. As the world’s second-largest consumer of bullion, India’s demand for gold is expected to drive global demand during the upcoming festive season. Additionally, gold exchange-traded funds (ETFs), which have been net sellers for the past two years, recorded purchases of 48,5 tons of gold, equivalent to $3,7 billion, in July, marking the third consecutive month of net buying. Physical gold demand is likely to continue supporting the upward trend in global gold prices as the Federal Reserve prepares to enter a phase of monetary policy easing later this year.

The USD Index rebounded nearly 0,5% yesterday due to technical buying at the end of the month, as the market awaited economic data that could determine the pace of the FED’s rate cuts. The PCE data tomorrow night and the labor market data next Friday could further weaken the USD if the figures come in below expectations. The USD/VND exchange rate recovered by about 45 dongs yesterday, closing at 24.870 as the market continued to see demand for USD payments to foreign partners at the end of the month. It is forecasted that levels below 24.900 will provide a suitable buying opportunity to capitalize on a short-term recovery in the exchange rate over the next 2-3 months.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn