Market Highlight 27.06.2024

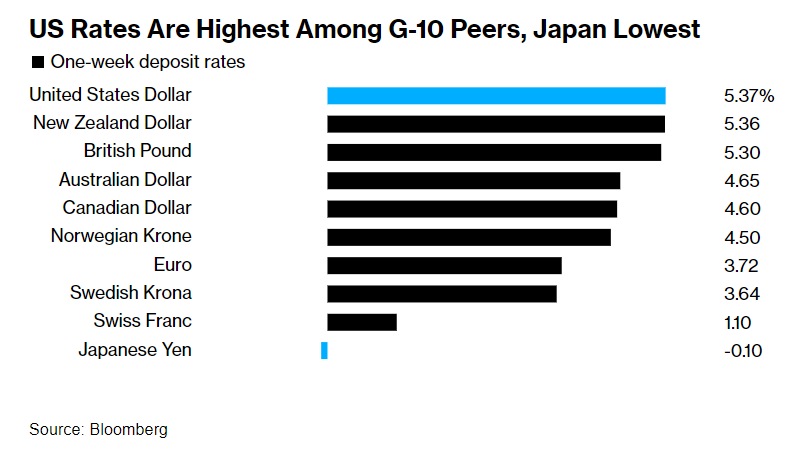

The USD Index rose more than 0,4% last night, supported by the increase in US government bond yields ahead of the crucial inflation (PCE) data release this Friday. Meanwhile, new home sales in the U.S in May fell to a six-month low, reinforcing previous assessments of a slowdown in the world's largest economy in Q2.

The USD/VND interbank exchange rate increased by 7 Dong yesterday while the effective ceiling rate for the day was 25.471. The pressure from the demand side is expected to remain high until early July, continuing to influence the exchange rate trend.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn