Market Highlight 27.05.2024

The USD was adjusted downward by nearly 0,3% last Friday but still recorded an increase of approximately 0,24% over the past week. The market participants have been gradually accepting the possibility that the FED will maintain high-interest rates for a longer period in the U.S. after the release of the minutes from the May meeting. Additionally, cautious statements from U.S. central bank policymakers expressed doubts about whether inflation is truly subsiding sustainably. This week’s data on the Personal Consumption Expenditures (PCE) price index from the U.S. and inflation in Europe for April will help clarify central banks’ concerns about the appropriate timing to cut interest rates. Last Friday’s data showed that new orders for U.S. made durable goods orders rebounded more than expected in April, and the previous day’s data indicated that U.S. economic activity reached its highest level in two years in May, boosting optimism about the outlook for the world’s largest economy. This has helped maintain the strength of the USD in the short term, around the 105-point level.

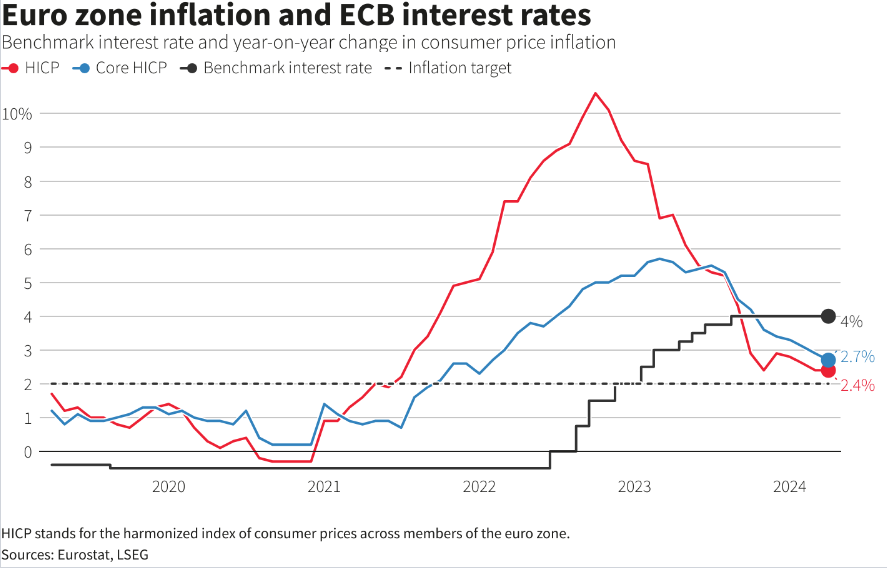

Meanwhile, this week’s European inflation report, although unlikely to prevent the European Central Bank from implementing its first rate cut on June 6, will determine the frequency of cuts this year. After closing last week above the resistance level of 1,0815, the EUR/USD pair is likely to target the 1,1040 (the highest level since the beginning of 2024) this week if the Q1 GDP data and April PCE data from the U.S fall below market expectations.

The USD/VND exchange rate maintained an upward trend last week and was traded below the ceiling rate set by the State Bank of Vietnam. The SBV continued to supply more than 300 Million USD to the market on last Friday, bringing the cumulative USD intervention sales in this phase to approximately 3,6 Billion USD. The upward trend in the USD/ VND exchange rate is expected to continue at the beginning of this week before gradually cooling down in the latter half of the week.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Ms. Hong Anh (Financial Markets Researcher) – Email: anhkh@acb.com.vn