Market Highlight 26.07.2024

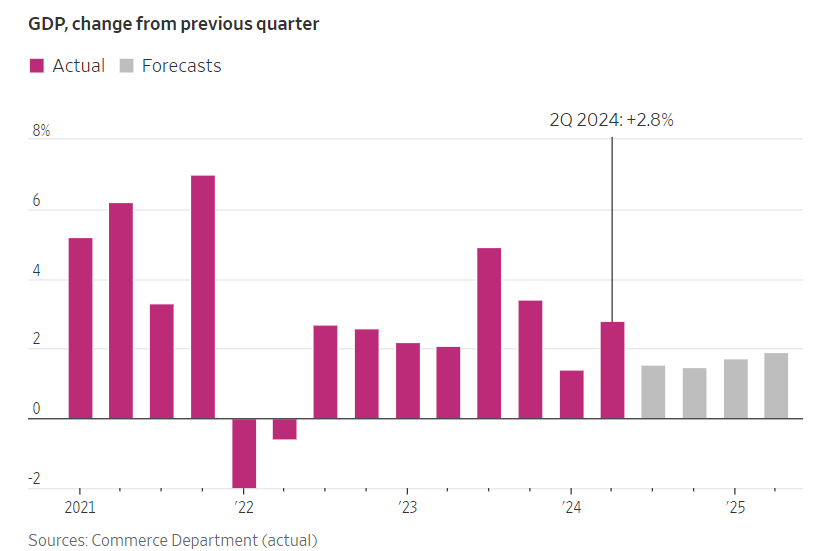

The U.S. economy grew at a rate of 2,8% in Q2, reaching a size of 22,9 Trillion USD, doubling the growth rate of Q1 and exceeding economists' expectations of 2%. Household spending, a key driver of the U.S. economy, increased at a faster pace as incomes rose, while businesses invested more in machinery and inventory as inflation eased. The GDP report showed solid economic growth despite the high inflation rates over the past two years, which prompted the Federal Reserve to raise interest rates at the fastest pace in decades. Increased consumer and business spending offset a decline in housing investment spending. A separate report indicated that the Personal Consumption Expenditures (PCE) price index, the FED's preferred inflation gauge, slowed in Q2. Excluding food and energy, the core PCE price index rose 2,9% in Q2, down from 3,7% in Q1 2024.

The USD Index slightly recovered yesterday after the release of Q2 GDP growth data, reinforcing the soft landing scenario for the economy. This reduced the urgency for a rate cut by the FED at next week's July policy meeting. However, the market anticipates that the FED might cut rates by 0,5% in September, rather than the previously expected 0,25%.

The USD/VND interbank exchange rate dropped nearly 50 Dong yesterday, following the general recovery of Asian currencies. There was no significant information on large foreign currency purchases during the day. The trend suggests that the exchange rate could continue to decline towards the target range of 25.250-25.300 by the end of this week.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn