Market Highlight 25.07.2024

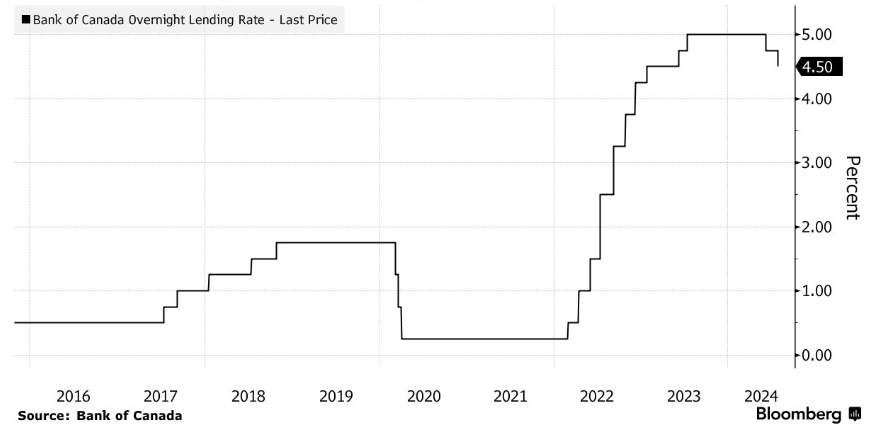

Last night, the Bank of Canada announced a further 0,25% cut in its base interest rate, bringing it down to 4,5%, and indicated that rates could be reduced further if inflation continues to cool as expected. In June, the BOC was the first central bank in the G7 to begin easing monetary policy, with the next rate cut expected in September.

The interbank USD/VND exchange rate declined yesterday, falling back below 25.360, despite briefly rising to nearly 25.400 during the day. Market sentiment remains cautious, awaiting key U.S economic data later this week and the FED's July policy meeting next week.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn