Market Highlight 23.09.2024

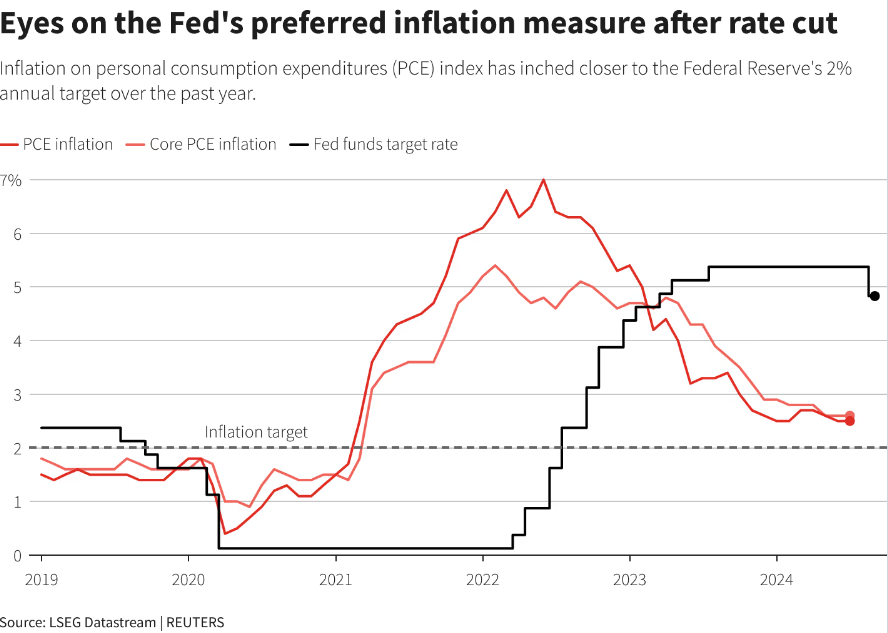

This week, attention will turn to a series of key speeches from several top members of the Federal Reserve’s policy-setting committee, including Chairman Jerome Powell on Thursday, which are expected to provide further insights into the decisions made during last week’s meeting and the central bank’s future policy trajectory. The most anticipated economic data this week will be Friday’s report on U.S Personal Consumption Expenditures (PCE) inflation, which will offer clarity on whether price pressures continue to ease as monetary policy has begun to loosen.

The USD/VND interbank exchange rate rebounded last week, rising by approximately 65 VND, closing at 24.610 by the end of the week. It is forecast that the exchange rate may revert to a downward trend in the final week of September as concerns over VND liquidity pressures at the end of the quarter resurface.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn