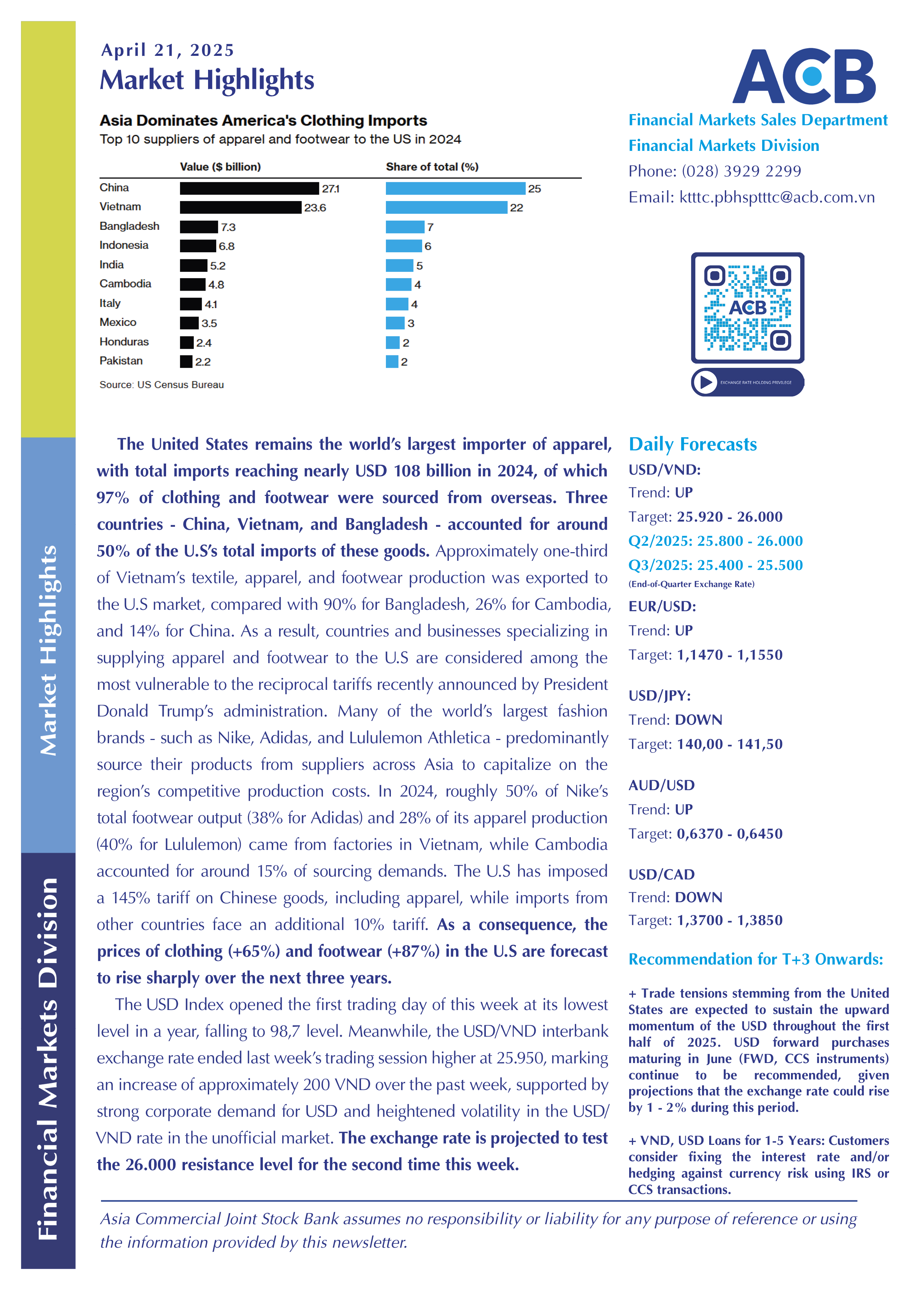

The United States remains the world’s largest importer of apparel, with total imports reaching nearly USD 108 billion in 2024, of which 97% of clothing and footwear were sourced from overseas. Three countries - China, Vietnam, and Bangladesh - accounted for around 50% of the U.S’s total imports of these goods. Approximately one-third of Vietnam’s textile, apparel, and footwear production was exported to the U.S market, compared with 90% for Bangladesh, 26% for Cambodia, and 14% for China. As a result, countries and businesses specializing in supplying apparel and footwear to the U.S are considered among the most vulnerable to the reciprocal tariffs recently announced by President Donald Trump’s administration. Many of the world’s largest fashion brands - such as Nike, Adidas, and Lululemon Athletica - predominantly source their products from suppliers across Asia to capitalize on the region’s competitive production costs. In 2024, roughly 50% of Nike’s total footwear output (38% for Adidas) and 28% of its apparel production (40% for Lululemon) came from factories in Vietnam, while Cambodia accounted for around 15% of sourcing demands. The U.S has imposed a 145% tariff on Chinese goods, including apparel, while imports from other countries face an additional 10% tariff. As a consequence, the prices of clothing (+65%) and footwear (+87%) in the U.S are forecast to rise sharply over the next three years.

The United States remains the world’s largest importer of apparel, with total imports reaching nearly USD 108 billion in 2024, of which 97% of clothing and footwear were sourced from overseas. Three countries - China, Vietnam, and Bangladesh - accounted for around 50% of the U.S’s total imports of these goods. Approximately one-third of Vietnam’s textile, apparel, and footwear production was exported to the U.S market, compared with 90% for Bangladesh, 26% for Cambodia, and 14% for China. As a result, countries and businesses specializing in supplying apparel and footwear to the U.S are considered among the most vulnerable to the reciprocal tariffs recently announced by President Donald Trump’s administration. Many of the world’s largest fashion brands - such as Nike, Adidas, and Lululemon Athletica - predominantly source their products from suppliers across Asia to capitalize on the region’s competitive production costs. In 2024, roughly 50% of Nike’s total footwear output (38% for Adidas) and 28% of its apparel production (40% for Lululemon) came from factories in Vietnam, while Cambodia accounted for around 15% of sourcing demands. The U.S has imposed a 145% tariff on Chinese goods, including apparel, while imports from other countries face an additional 10% tariff. As a consequence, the prices of clothing (+65%) and footwear (+87%) in the U.S are forecast to rise sharply over the next three years.

The USD Index opened the first trading day of this week at its lowest level in a year, falling to 98,7 level. Meanwhile, the USD/VND interbank exchange rate ended last week’s trading session higher at 25.950, marking an increase of approximately 200 VND over the past week, supported by strong corporate demand for USD and heightened volatility in the USD/VND rate in the unofficial market. The exchange rate is projected to test the 26.000 resistance level for the second time this week.

Please contact the nearest Asia Commercial Joint Stock Bank's branch to receive information and consultancy if you are in need of making any foreign exchange and derivatives transactions.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn