Market Highlight 20.01.2025

Two major events in focus for global financial markets this week are the inauguration of President Donald Trump and the Bank of Japan’s (BOJ) January policy meeting. President Trump’s second-term inauguration as the 47th U.S President will be accompanied by a series of executive orders spanning tariffs to immigration. These measures could have substantial impacts on financial markets, particularly the USD and U.S Treasury yields, given the current lack of clarity among economists on the scope and magnitude of upcoming policy adjustments.

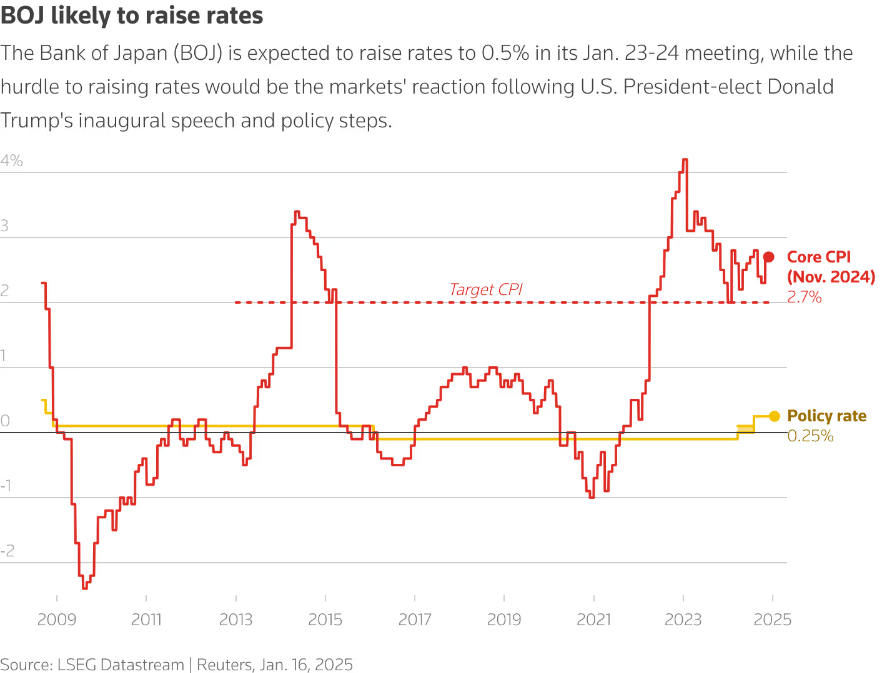

Meanwhile, the BOJ is expected to discuss a possible interest rate hike on Friday amid concerns over potential U.S policy shifts that may further weaken the yen. Market expectations overwhelmingly favor the BOJ to raise its policy rate by 0,25% to 0,5%, unless tariff policies announced by the new U.S administration trigger significant market volatility. Any rate increase would narrow the interest rate gap between the U.S and Japan, supporting yen strength after the currency’s repeated tests of $160, a level where the BOJ intervened twice last year by selling U.S dollars.

The USD Index advanced by more than 0,4% to 109,4 ahead of President Trump’s inauguration. Domestically, the USD/VND interbank exchange rate slipped by another 30 VND on Friday to 25.330, marking a total drop of 70 VND since early last week. Short-term VND liquidity is likely to dominate market dynamics this week. If VND demand remains high in the run-up to the nine-day Lunar New Year holiday, the exchange rate could feasibly dip to 25.200 - 25.250.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn