Market Highlight 19.11.2024

The Governor of the Bank of Japan (BOJ) stated yesterday that a further interest rate hike remains possible before the new U.S administration takes office, though no specific timeline for such action was provided. The USD has appreciated recently on expectations that higher tariffs could accelerate inflation by raising the cost of imported goods into the U.S, pushing the JPY to its lowest level in nearly 4 months. A weaker yen heightens inflationary pressure as Japan relies heavily on imported food and energy. With the significant depreciation of the domestic currency, markets are increasingly anticipating that the BOJ may raise interest rates at its next policy meeting on December 18-19.

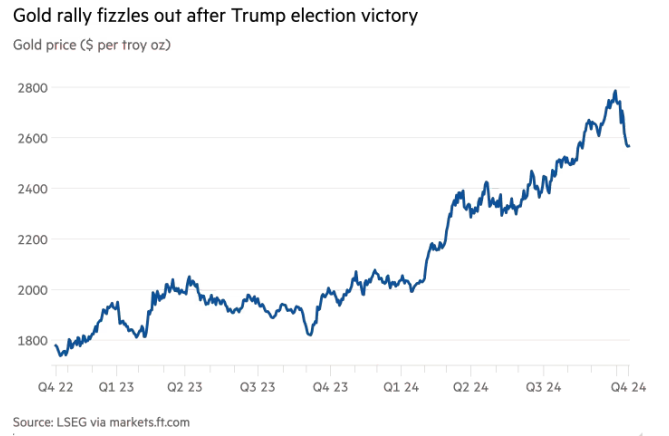

The USD Index recorded its second consecutive day of losses yesterday, closing at 106,23 (-0,44%). Previously, the index had reached a 14-month high of 107,07 last week, driven by expectations that President D. Trump’s victory could escalate trade tensions, fueling inflation in the U.S and potentially slowing the Federal Reserve’s pace of interest rate cuts. Recent comments from Federal Reserve officials, including Chair Jerome Powell, have highlighted a cautious approach toward the next steps in monetary policy. Markets currently assign nearly a 60% probability to another 0,25% rate cut at the FED’s upcoming policy meeting on December 19.

The USD/VND interbank rate increased by 30 VND yesterday, closing above 25.400 as demand for USD emerged from FDI enterprises. On a positive note, the upward pressure from the USD has eased over the past two days. The exchange rate is expected to remain around the 25.400 level today.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn