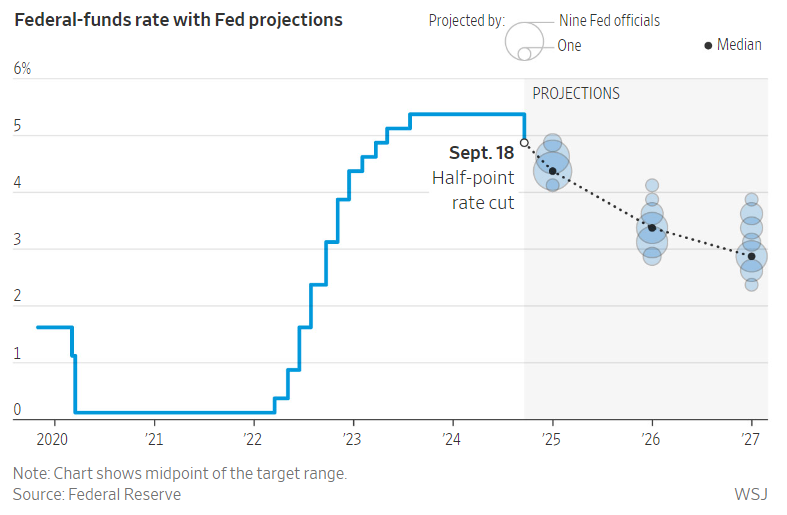

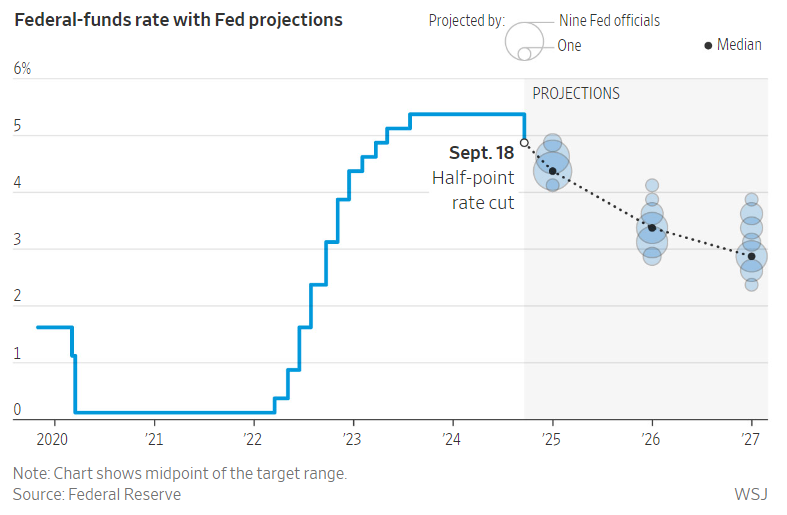

The Federal Reserve announced a 0,5% cut to its benchmark interest rate last night, marking the beginning of a monetary easing cycle with the first rate reduction since 2020. This long-anticipated adjustment follows the comprehensive fight against inflation that the FED initiated two years ago. Of the 12 FOMC members, 11 supported the cut, bringing the policy rate down to 4,75% - 5%. The latest interest rate projections released by the FED last night also indicate that the majority of members favor two additional 0,25% cuts at the upcoming meetings in November and December. The FED aims to mitigate the effects of the previous rate hikes, which had pushed interest rates to their highest levels in 2 decades last year, further weakening the labor market. Inflation in the U.S has now fallen to 2,5% in August, down from around 5,5% in January 2023. Wage growth has slowed in recent months, while oil prices have dropped by 19% since April. Looking ahead to 2025, 4 additional rate cuts of 0,25% are anticipated, assuming unemployment does not rise and inflation continues to cool. This would bring the policy rate down to below 3,5% by the end of 2025. The USD Index fluctuated within a wide range of 100,2 to 101,1 points last night and ended the session with a slight decline (-0,08%) following the FED’s interest rate decision.

The Federal Reserve announced a 0,5% cut to its benchmark interest rate last night, marking the beginning of a monetary easing cycle with the first rate reduction since 2020. This long-anticipated adjustment follows the comprehensive fight against inflation that the FED initiated two years ago. Of the 12 FOMC members, 11 supported the cut, bringing the policy rate down to 4,75% - 5%. The latest interest rate projections released by the FED last night also indicate that the majority of members favor two additional 0,25% cuts at the upcoming meetings in November and December. The FED aims to mitigate the effects of the previous rate hikes, which had pushed interest rates to their highest levels in 2 decades last year, further weakening the labor market. Inflation in the U.S has now fallen to 2,5% in August, down from around 5,5% in January 2023. Wage growth has slowed in recent months, while oil prices have dropped by 19% since April. Looking ahead to 2025, 4 additional rate cuts of 0,25% are anticipated, assuming unemployment does not rise and inflation continues to cool. This would bring the policy rate down to below 3,5% by the end of 2025. The USD Index fluctuated within a wide range of 100,2 to 101,1 points last night and ended the session with a slight decline (-0,08%) following the FED’s interest rate decision.

The USD/VND exchange rate edged lower and traded within a narrow range yesterday as the market awaited the FED meeting results. At one point during the day, the exchange rate climbed to 24.690 before retreating to 24.625 by the end of the session. The FED’s rate cut had already been priced into the recent significant decline in the exchange rate. With 2 months remaining until the FED’s next meeting, this may provide a necessary pause for the recovery of the U.S dollar. Liquidity in the Vietnamese dong on the interbank market at the end of Q3 and the pressure from USD payment demand in the latter half of September are expected to drive the next phase of exchange rate movements.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn