Market Highlight 18.06.2025

Retail sales in the United States fell for the second consecutive month, signaling that concerns over tariffs and personal finances have led consumers to scale back spending following a surge earlier this year. According to data released by the U.S Department of Commerce on Tuesday evening, retail sales in May dropped by 0,9% - the sharpest decline since the beginning of the year - following a 0,1% decrease in April. The report showed that 7 out of 13 tracked categories registered declines, including building materials, gasoline, and motor vehicles. These drops came after a buying spree earlier this year as consumers moved to make purchases ahead of the implementation of new tariffs. Spending in service-related categories such as restaurants and bars also posted the steepest fall since early 2023. Although tariffs have yet to significantly fuel inflation in the U.S, consumer sentiment remains subdued. Households continue to face financial strain due to persistently high living costs and elevated interest rates, which have dampened confidence in the broader economic outlook. The latest forecast from the Federal Reserve Bank of Atlanta estimates U.S GDP growth at 3,8% for the second quarter, suggesting a rebound from the first-quarter contraction, which was largely driven by a surge in imports ahead of President D. Trump’s tariff measures.

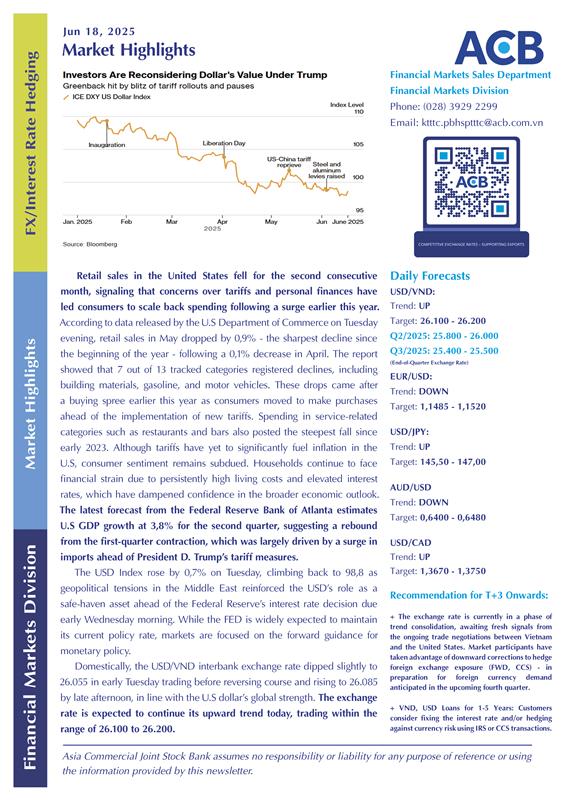

The USD Index rose by 0,7% on Tuesday, climbing back to 98,8 as geopolitical tensions in the Middle East reinforced the USD’s role as a safe-haven asset ahead of the Federal Reserve’s interest rate decision due early Wednesday morning. While the FED is widely expected to maintain its current policy rate, markets are focused on the forward guidance for monetary policy.

Domestically, the USD/VND interbank exchange rate dipped slightly to 26.055 in early Tuesday trading before reversing course and rising to 26.085 by late afternoon, in line with the U.S dollar’s global strength. The exchange rate is expected to continue its upward trend today, trading within the range of 26.100 to 26.200.

Please contact the nearest Asia Commercial Joint Stock Bank's branch to receive information and consultancy if you are in need of making any foreign exchange and derivatives transactions.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn