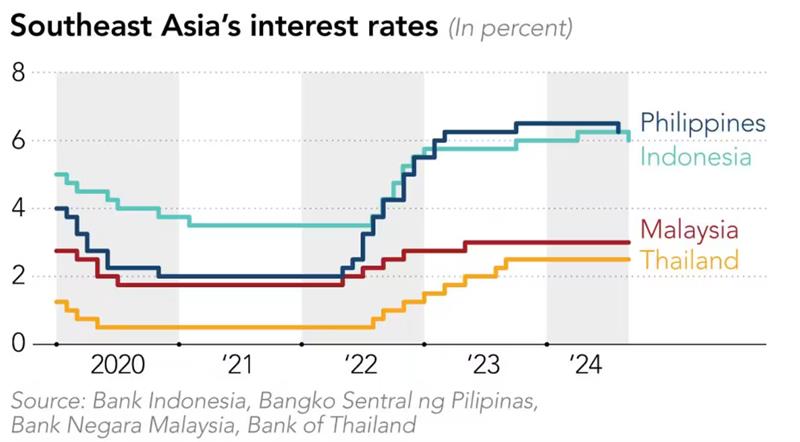

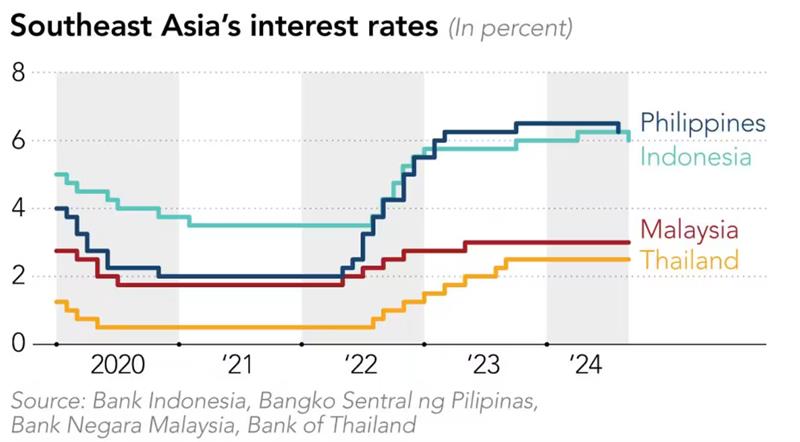

The interest rate trajectories of Central banks in Southeast Asia have diverged significantly after the U.S Federal Reserve began cutting rates last month. While Central banks in export-driven countries like Thailand and Malaysia are expected to only start easing next year or reduce rates at a slower pace, in Indonesia and the Philippines, this process is expected to unfold more quickly to support growth by boosting domestic consumer demand. Over the past two years, Southeast Asian central banks rapidly increased policy rates due to pressure from global inflation and the strength of the USD. Inflation squeezed domestic consumption, while weaker local currencies raised the burden of repaying USD-denominated debt. Weak growth and depreciating currencies led to capital outflows from countries like Malaysia and Thailand. Since the start of 2024, the situation has begun to change, as inflation stabilized and regional currencies appreciated significantly since July when the FED signaled a return to more accommodative monetary policy for the U.S economy. The currencies of Malaysia and Thailand have been the strongest performers in the region against the USD, appreciating by around 6,5% and 3%, respectively, this year as of October 15.

The interest rate trajectories of Central banks in Southeast Asia have diverged significantly after the U.S Federal Reserve began cutting rates last month. While Central banks in export-driven countries like Thailand and Malaysia are expected to only start easing next year or reduce rates at a slower pace, in Indonesia and the Philippines, this process is expected to unfold more quickly to support growth by boosting domestic consumer demand. Over the past two years, Southeast Asian central banks rapidly increased policy rates due to pressure from global inflation and the strength of the USD. Inflation squeezed domestic consumption, while weaker local currencies raised the burden of repaying USD-denominated debt. Weak growth and depreciating currencies led to capital outflows from countries like Malaysia and Thailand. Since the start of 2024, the situation has begun to change, as inflation stabilized and regional currencies appreciated significantly since July when the FED signaled a return to more accommodative monetary policy for the U.S economy. The currencies of Malaysia and Thailand have been the strongest performers in the region against the USD, appreciating by around 6,5% and 3%, respectively, this year as of October 15.

The USD continued its upward momentum yesterday, gaining nearly 0,3% to reach a 10-week high. Recent surveys unexpectedly show an advantage for candidate Donald Trump ahead of the U.S Presidential Election. The former president’s economic policies, which focus on cutting taxes for U.S businesses, loosening financial regulations, and increasing tariffs on imports, are seen as favorable for the USD. Domestically, the USD/VND exchange rate briefly reached 25.015 yesterday before closing the day at 24.985. The exchange rate is expected to hover near the 25.000 level while awaiting further signals regarding the USD from key economic data releases later this week.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn