Market Highlight 16.12.2024

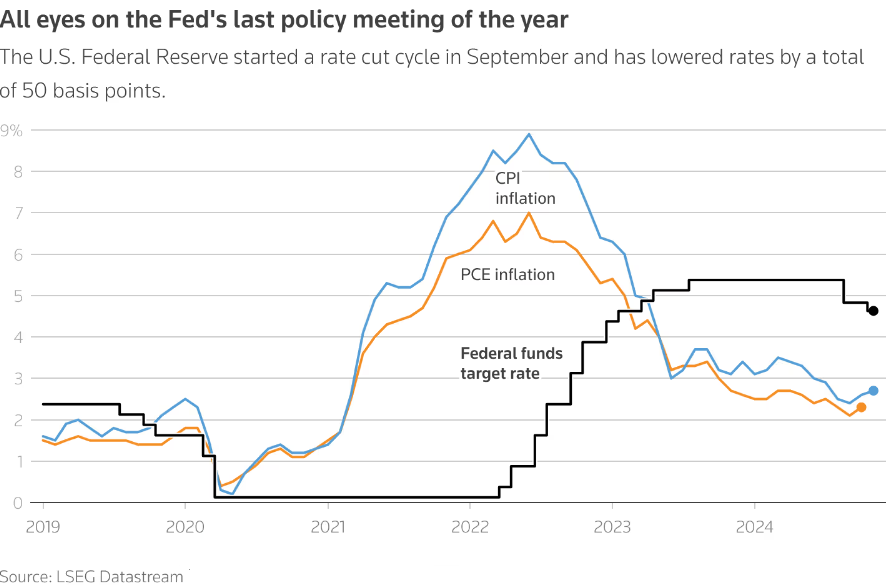

The USD Index rose nearly 0,9% last week, marking its strongest weekly gain in a month as markets anticipated a slower pace of rate cuts by the Federal Reserve in 2025. Projections overwhelmingly favor a 0,25% rate cut at the conclusion of the FED’s meeting this Thursday morning, but only about a 25% probability is assigned to another rate cut in January, coinciding with President-elect Donald Trump’s inauguration. This week’s release of PMI data from leading global economies is expected to provide further clarity on economic conditions after November figures revealed a shift in economic stagnation from the manufacturing sector to services.

The Bank of Japan (BOJ) is also set to hold a crucial policy meeting this Thursday. Based on recent comments from BOJ policymakers, the market currently assigns only a 25% probability of a 0,25% rate hike. This hesitancy stems from the BOJ’s preference to await further data on wage growth in Japan during the year’s final months and to observe how U.S policies evolve under the new administration. The JPY depreciated an additional 2,41% against the USD last week, closing at $153,64. If the BOJ decides to maintain its policy rate this week, the USD/JPY exchange rate could climb back above the 155 level.

Domestically, the USD/VND exchange rate closed at 25.400 last Friday, with a relatively narrow trading range throughout most of the session. The upward momentum of the USD in global markets continues to exert significant influence on domestic exchange rate trends, despite observed improvements in foreign currency supply. The market is expected to remain stable around the 25.350 - 25.400 range as it awaits clearer policy signals from the Federal Reserve later this week.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn