Market Highlight 16.08.2024

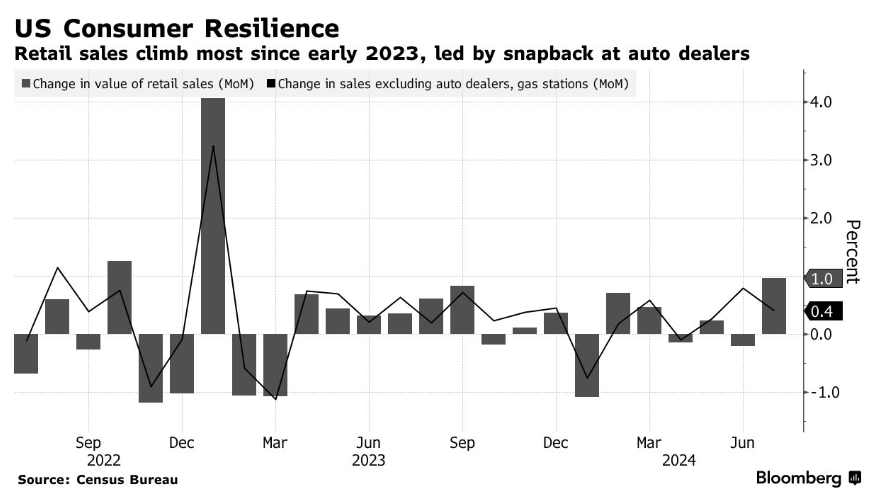

The number of Americans filing new unemployment claims fell to its lowest level in a month last week, indicating that while the labor market is slowing, it is not as negative as previously feared. The economic recovery was further bolstered by other data showing that U.S retail sales in July saw the strongest increase in nearly 1,5 years. This reduces the likelihood that the Federal Reserve will opt for a 0,5% rate cut in September. Currently, the expectation that the FED might reduce its policy rate by 0,5% at the September 17-18 meeting has dropped from around 40% before the data release to 28%. Meanwhile, the likelihood of a 0,25% rate cut has risen from nearly 60% to 72%. The USD Index rebounded by 0,46% last night, supported by positive data from the world's largest economy, easing fears of a recession and reducing expectations of an aggressive rate cut by the FED.

Meanwhile, the consumer sector in China showed signs of improvement in July, although the pace of investment growth slowed, and ongoing challenges in the real estate sector continue to cloud the outlook for the world's second-largest economy. Previously, the Chinese government implemented various measures to boost household income and consumer spending. However, it remains uncertain whether the improvement in retail sales can offset the decline in domestic investment in overall GDP growth. Many organizations have downgraded their growth forecasts for China this year to 4,7% from the previous estimate of 5,2%.

The USD/VND exchange rate recorded its lowest level yesterday at 25.030 before recovering slightly by the end of the day to 25.045. Currently, there are no sufficiently strong factors to push the exchange rate below 25.000. The upward trend is expected to resume today, targeting a level above 25.100.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn