Market Highlight 16.01.2025

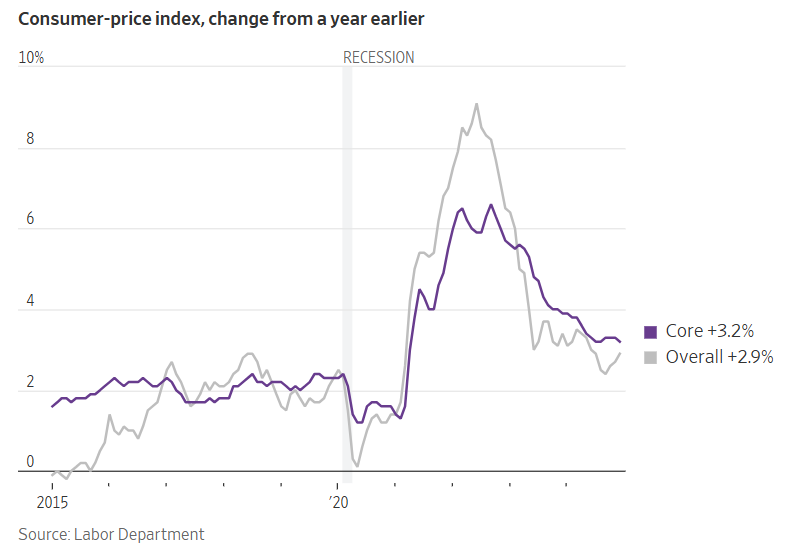

On Wednesday evening, the U.S Department of Labor reported that December’s Consumer Price Index (CPI) rose 2,9% year-on-year, with a 0,4% increase month-on-month, driven largely by a 4,4% uptick in gasoline prices. Core CPI, which excludes food and energy, climbed 0,2% - its smallest gain since July and below the 0,3% forecast. Although market sentiment improved on signs that underlying price pressures are easing, the Federal Reserve (FED) is unlikely to proceed with additional rate cuts in the near term, given the incoming policy measures that President-elect Donald Trump is expected to enact for the U.S economy.

Overall, U.S inflation remains significantly above the FED’s 2% target. The central bank meets in 2 weeks and has signaled broadly that it will pause further cuts to policy rates. Ten-year U.S Treasury yields declined to approximately 4,653% from 4,787% on Tuesday - their largest single-day drop since November. Market odds suggest a 16% likelihood that the FED will refrain from additional rate cuts in 2025, down from 26% the previous day, while the probability of 2 more cuts has risen from 35% to around 50% after the U.S CPI data. According to a report from JPMorgan last week, a potential 10% hike on import duties - one of President Trump’s policy options - would raise U.S consumer prices by 0,3% - 0,6%.

The USD Index fell 0,1% to 109,07 last night, after reaching a 26-month peak of 110,17 on Monday. Domestically, the USD/VND exchange rate remained steady at 25.385 yesterday, as the market lacked directional drivers while participants awaited key U.S economic data scheduled for release later in the evening. The exchange rate is forecast to soften slightly today, trading largely within the 25.350 - 25.400 range.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn