Market Highlight 15.01.2025

The USD weakened against the EUR (-0,63%) yesterday but remained close to its two-year high of $1,03, as lower-than-expected U.S producer inflation data following last week’s robust jobs report, leaving markets unsure about the Federal Reserve’s next rate policy moves. To be more specific, Producer Price Index (PPI) data for December showed a 0,2% increase - below forecasts. Overall, PPI inflation for 2024 was +3,3%, higher than +1,1% in 2023. The PPI is closely monitored in part because it, along with CPI data, factors into the Personal Consumption Expenditures (PCE) price index - a key inflation gauge favored by the FED. Markets now turn their attention to U.S December CPI and retail sales reports due later this week to assess the potential pace of further monetary easing by the central bank this year. Forecasts suggest the timing of the FED’s next rate cut could be pushed from June to September, with the likelihood of only one additional rate reduction this year.

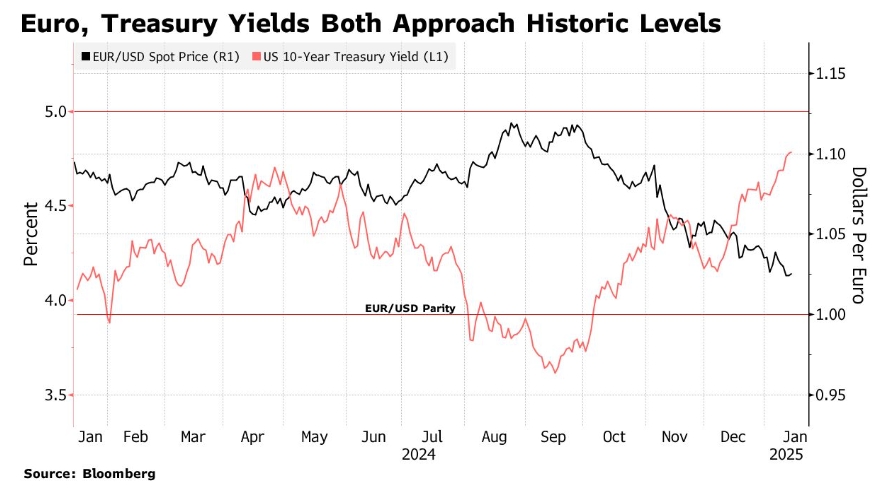

The EUR’s performance against the USD will likely depend significantly on U.S Treasury yield movements in the near term. The recent jump of the USD to a two-year high coincided with the 10-year Treasury yield rising to about 4,8% on Tuesday. Should yields climb to 5%, the EUR could slip to parity with the USD, while reaching EUR/USD 0,95 would likely require additional pressure from potential trade tensions between the U.S and EU once President Donald Trump’s new term begins.

Domestically, the USD/VND exchange rate held steady at around 25.400 yesterday and is expected to continue hovering at this level today. On the free market, the exchange rate currently trades in the 25.600 - 25.700 range.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn