Market Highlight 14.08.2024

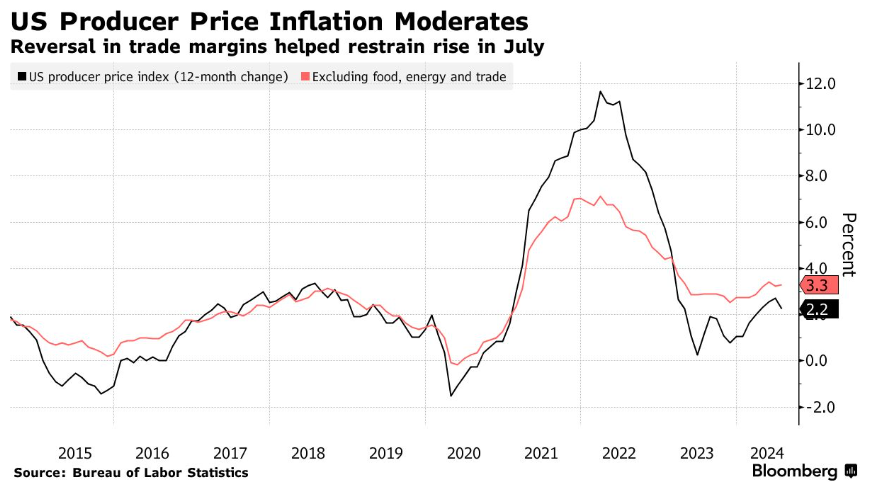

The USD Index dropped sharply by nearly 0,5% to 102,6 points at the close of yesterday's trading session, following the release of data showing that U.S Producer Price Index (PPI) growth was lower than expected in July. Specifically, the PPI rose by only 0,1% from the previous month and 2,2% year-over-year, as costs for machinery and motor vehicle sales services cooled. This data provided further positive signals, indicating that inflation continues to ease in the U.S, as the market anticipates the release of crucial CPI data tonight. U.S stock indices maintained strong upward momentum after the positive inflation signal, bolstering expectations that the FED could cut interest rates by 0,5% in September, with the Dow Jones rising by over 1%, the S&P 500 by 1,68%, and the Nasdaq by 2,4%.

The latest report from the Federal Reserve Bank of Atlanta indicates that the U.S economy could sustain robust growth of around 2,9% this year, higher than the 2,8% recorded in Q2. Atlanta FED President Raphael Bostic stated last night that recent economic data has made him "more confident" that inflation can be brought back to the 2% target, but he wants to see a bit more positive data before supporting a rate cut. The FED is keen to avoid the risk of cutting rates too early, only to have to raise them again later if inflation accelerates.

The USD/VND exchange rate remained relatively stable yesterday, trading mainly around 25.120 – 25.130 as the market awaited key U.S. economic data this week, which could determine the scale of the FED's first rate cut in September. With the USD's weakening trend on the global market last night, it is likely that the domestic exchange rate may slightly decrease at the start of today, trading primarily in the 25.050 – 25.120 range.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn