Market Highlight 14.04.2025

According to the General Department of Vietnam Customs (Ministry of Finance), bilateral trade between Vietnam and China surpassed the USD 200 billion threshold for the first time in 2024 - an unprecedented milestone in Vietnam’s economic relations with any single country. The traded goods between the two nations span a wide range of categories, from agricultural products to consumer goods and electronic components. In the first quarter of 2025, bilateral trade reached USD 51,25 billion, with Vietnam exporting USD 13,17 billion and importing USD 38,08 billion, resulting in a trade deficit of USD 24,9 billion in China’s favor. Projections suggest that trade volume between the two countries could expand to USD 300 - 400 billion over the next 5 - 10 years, driven by geographical proximity, market scale, and complementary trade structures.

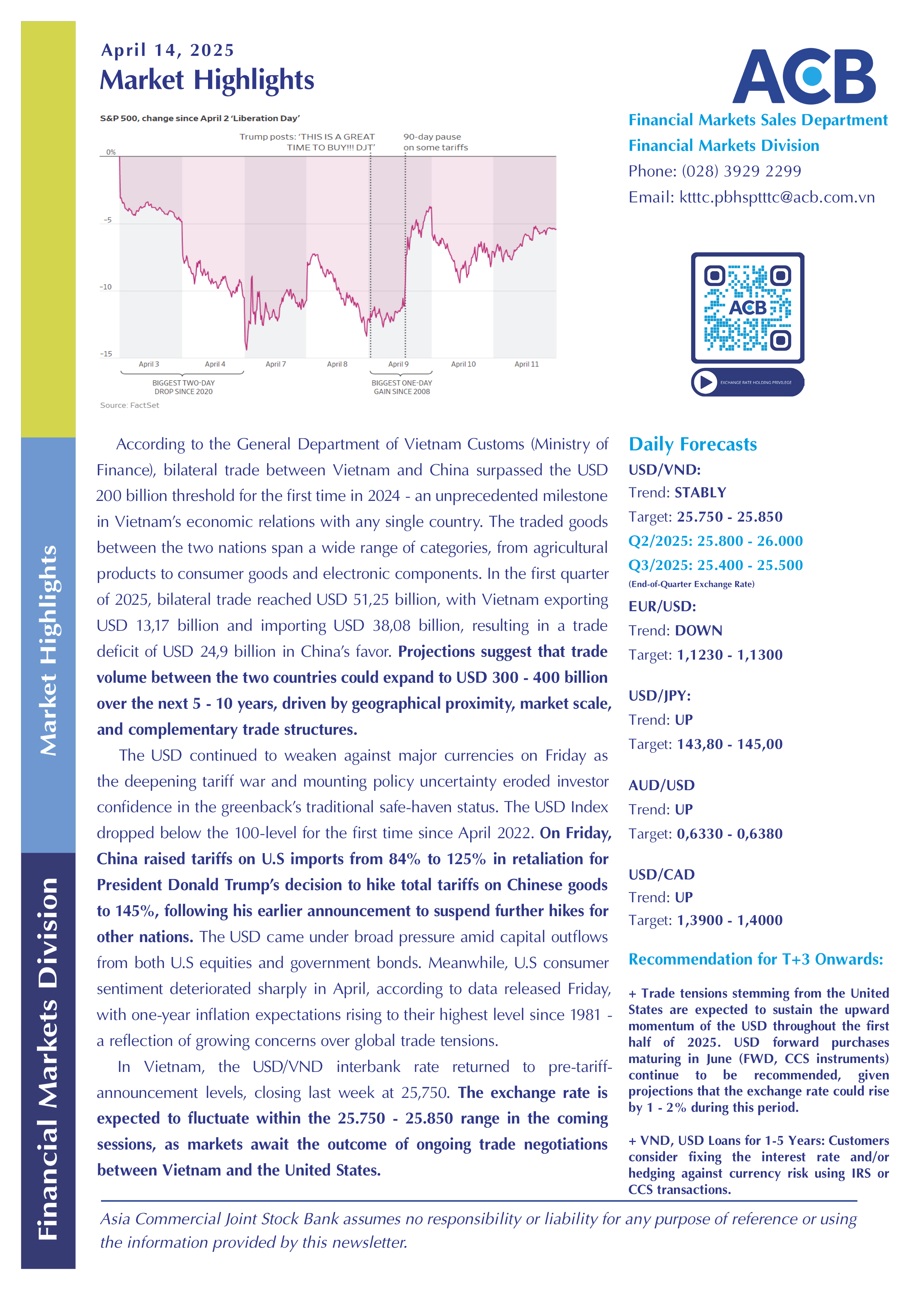

The USD continued to weaken against major currencies on Friday as the deepening tariff war and mounting policy uncertainty eroded investor confidence in the greenback’s traditional safe-haven status. The USD Index dropped below the 100-level for the first time since April 2022. On Friday, China raised tariffs on U.S imports from 84% to 125% in retaliation for President Donald Trump’s decision to hike total tariffs on Chinese goods to 145%, following his earlier announcement to suspend further hikes for other nations. The USD came under broad pressure amid capital outflows from both U.S equities and government bonds. Meanwhile, U.S consumer sentiment deteriorated sharply in April, according to data released Friday, with one-year inflation expectations rising to their highest level since 1981 - a reflection of growing concerns over global trade tensions.

In Vietnam, the USD/VND interbank rate returned to pre-tariff-announcement levels, closing last week at 25,750. The exchange rate is expected to fluctuate within the 25.750 - 25.850 range in the coming sessions, as markets await the outcome of ongoing trade negotiations between Vietnam and the United States.

Please contact the nearest Asia Commercial Joint Stock Bank's branch to receive information and consultancy if you are in need of making any foreign exchange and derivatives transactions.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn