Market Highlight 14.01.2025

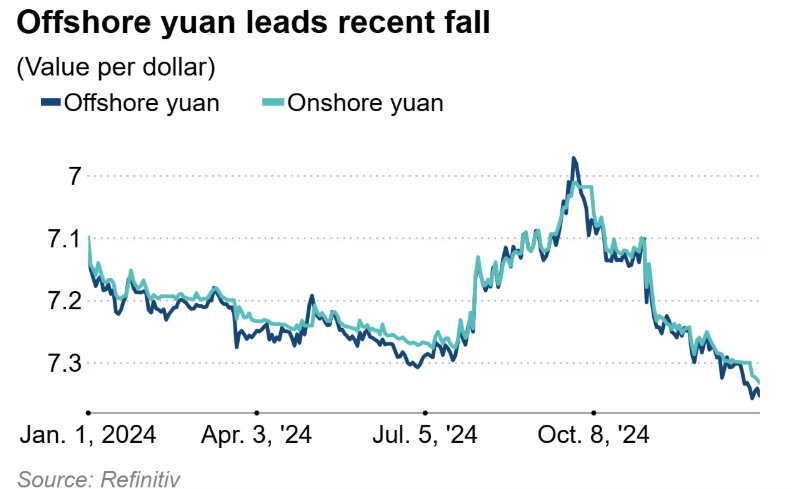

Growing indications suggest that China is gradually accepting a weaker CNY this year to help exporters offset potentially higher tariffs, should President Trump fulfill his pledge to raise import duties. However, any depreciation must proceed gradually to avert capital flight from China, diminish its aspiration to establish the yuan as a global reserve currency, and intensify trade tensions with the U.S. Forecasts show that a $7,5 level is attainable within the next 3 months, with a more optimistic recovery scenario contingent upon either a severe U.S recession or the Federal Reserve resuming aggressive rate cuts.

The USD/VND exchange rate initially climbed by nearly 50 VND to 25.430 yesterday, propelled by the greenback’s rally following the release of robust U.S December employment data. However, by market close, the exchange rate settled back to 25.400, a trend likely to continue today given the domestic market’s focus on elevated VND demand with just over 10 days remaining until the Lunar New Year. The exchange rate is anticipated to dip back below 25.400 by the end of today’s trading session.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn