Market Highlight 13.12.2024

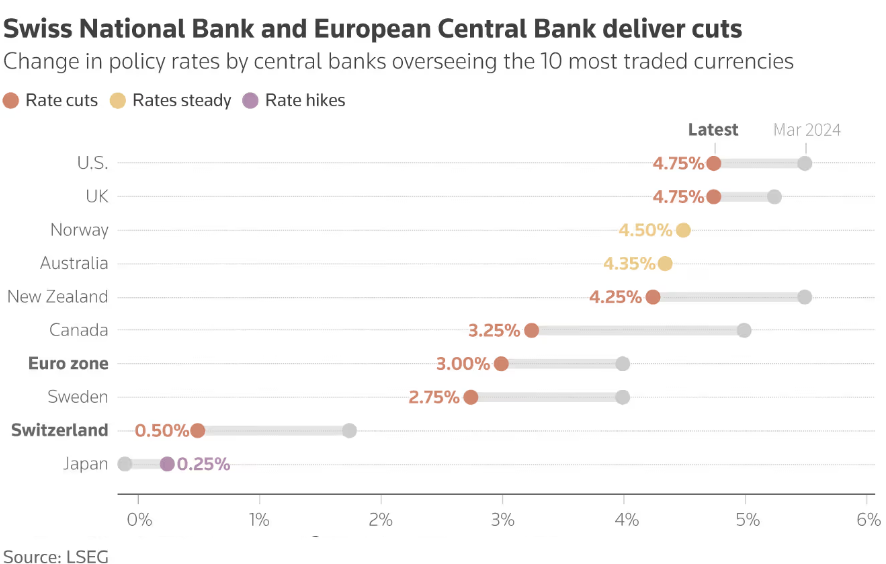

The USD Index rose by 0,36% yesterday following higher-than-expected U.S factory price data, while the EUR weakened to $1,0466 after the European Central Bank (ECB) announced its fourth rate cut this year. A report from the U.S Department of Labor revealed that the Producer Price Index (PPI) increased by 0,4% in November, surpassing the previous estimate of a 0,2% rise. The market is now almost fully pricing in the likelihood of a 0,25% rate cut by the Federal Reserve at its December 17-18 meeting, compared to roughly 80% last week. However, recent rate cuts by the central banks of Canada, Switzerland, and the Eurozone have ensured that the interest rate differential with the U.S remains intact, reinforcing the USD’s dominance over other major currencies.

Last night, the ECB announced another rate cut to stimulate the Eurozone’s slowing economy. The 0,25% policy rate reduction (from 3,25% to 3%) aims to stabilize an economy affected by political instability in France and Germany and potential U.S tariffs on European exports. The ECB also downgraded its growth forecasts, projecting the Eurozone economy to grow by only 0,7% this year and 1,1% in 2025. Markets expect the ECB to cut rates more aggressively than the Federal Reserve in the coming months, with a terminal rate of around 1,75% by the end of 2025, approximately 2% lower than the FED’s. This divergence could negatively impact the EUR’s outlook, with the currency forecast to reach parity with the USD next year.

Domestically, the USD/VND exchange rate traded within a narrow range of 25.390 - 25.400 yesterday, tracking the USD’s strength in global markets. The exchange rate is expected to continue its modest upward trend in today’s session and remain above 25.400.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn