Market Highlight 13.03.2025

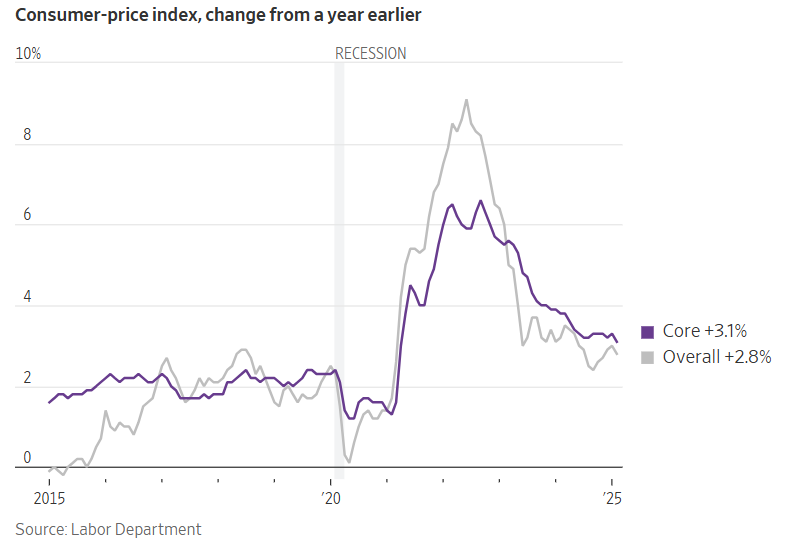

According to a report from the U.S Department of Labor on Wednesday evening, consumer prices rose 2,8% in February from a year earlier, compared to 3% in January and slightly below the 2,9% increase forecast by economists. The core CPI, which excludes food and energy prices, increased by 3,1%, marking the lowest level since 2021. While inflation cooled last month, the latest data may offer little reassurance to businesses, U.S consumers, and Federal Reserve policymakers, as tariffs continue to pose inflationary risks in the coming months. Inflationary pressures have fueled consumer concerns, with the University of Michigan’s consumer sentiment index falling nearly 10% in the February survey, while consumer spending in January recorded the largest monthly decline in four years. The February CPI report is unlikely to alter the FED’s decision to keep interest rates unchanged when policymakers convene next week. If tariffs sustain elevated inflation, it could limit the FED’s ability to lower interest rates quickly even if economic weaknesses emerge, as policymakers fear that efforts to prevent a recession could further fuel inflationary pressures.

The USD Index rebounded slightly by 0,15% yesterday as market sentiment improved following data showing that U.S inflation slowed in February. In the domestic market, the USD/VND interbank exchange rate edged 15 VND lower but remained above 25.450. Elevated VND interbank interest rates have helped curb the upward pressure on the exchange rate, in addition to the recent weakness of the USD in global markets. The exchange rate is expected to rise slightly, hovering around 25.500, as some USD purchase orders are scheduled to be executed today.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn