Market Highlight 13.02.2025

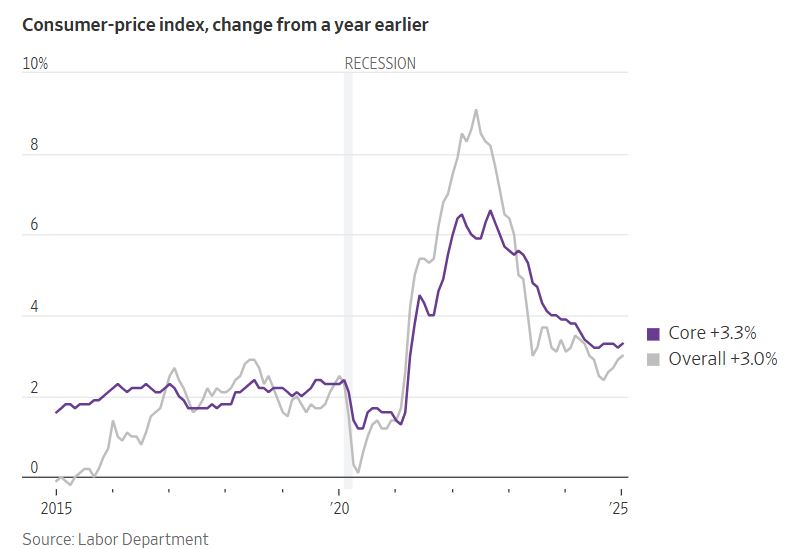

The U.S Consumer Price Index (CPI) surged in January, extending its recent upward trend and potentially derailing expectations for Federal Reserve rate cuts this year. The U.S Department of Labor reported last night that the CPI rose by 0,5% in the previous month compared to December, marking a 3% increase year-over-year. This was the largest monthly gain since August 2023 and significantly exceeded prior forecasts of 0,3%. The larger-than-expected price increase last month was primarily driven by higher used car prices and auto insurance costs. Economists are concerned that the import tariffs imposed by President Donald Trump could further fuel inflation in the coming months, despite some administration officials suggesting that deregulation efforts and increased energy production could offset the impact of rising commodity prices. The market now anticipates that the Federal Reserve will implement just one additional rate cut by the end of this year, in part due to the potential inflationary effects of large-scale tariff hikes, which may complicate the FED’s fight against inflation. While the possibility of the FED considering a rate hike remains on the table, such a scenario would depend on whether inflation surges over the next three months and whether labor demand continues to outstrip the number of job seekers. Meanwhile, the White House is expected to announce reciprocal tariffs today against countries that impose duties on U.S imports.

The USD/VND interbank exchange rate surged past the 25.600 threshold early yesterday morning, driven by the State Bank of Vietnam’s (SBV) latest upward adjustment of the central exchange rate and heightened concerns over escalating global trade tensions. However, strong selling pressure throughout the remainder of the session pushed the rate down to 25.560 by the end of the day. Looking ahead, USD demand from the State Treasury could provide some upside momentum early today before the market stabilizes in the 25.480 - 25.550 range.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn