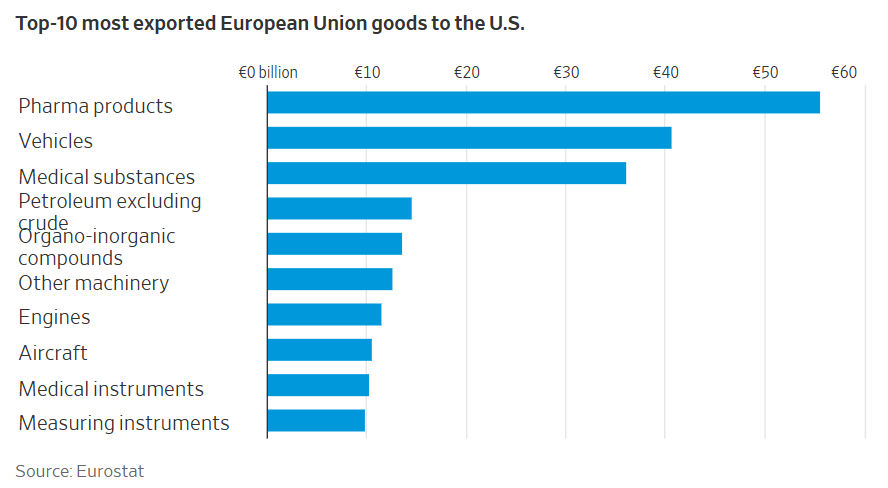

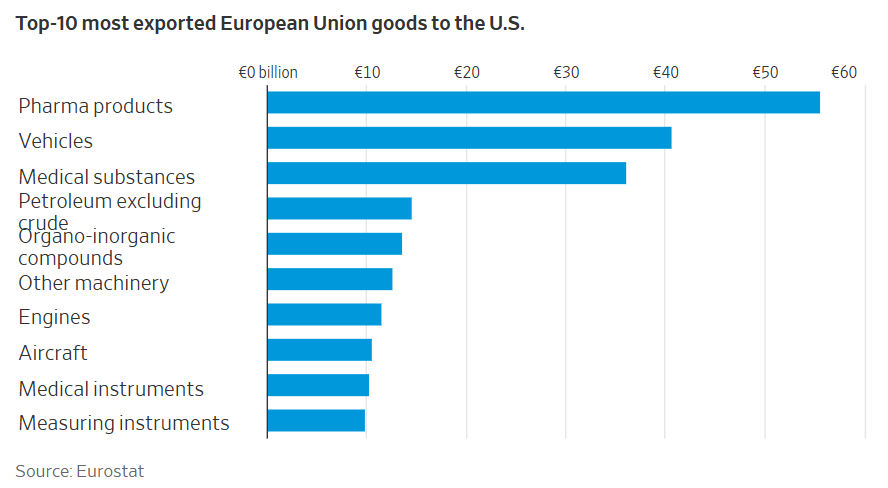

President Donald Trump’s second term could bring significant challenges for the European Union’s export-dependent economy, which is already struggling with sluggish growth and a deepening political crisis. The U.S remains the largest export market for both the EU and Germany, with top exports including pharmaceuticals, machinery, and automobiles. During his campaign, President-elect Trump pledged to impose a 60% tariff on imports from China and 10% to 20% tariffs on other trade partners. Studies estimate that such an increase in tariffs could reduce Germany’s GDP by 1,2% to 1,4% compared to baseline projections for 2028. The EU’s export engine is under pressure, facing constraints from the loss of cheap Russian energy, slow adaptation to the electric vehicle transition, and heavy reliance on exports to China. Another risk is that China may divert more low-cost goods to Europe if a trade war with the U.S escalates. Caught between U.S - China trade tensions, Europe’s economic outlook may soon face its most significant challenge since the eurozone crisis. The EUR/USD pair is forecast to potentially decline to the 1,02 - 1,04 range in the first half of 2025.

President Donald Trump’s second term could bring significant challenges for the European Union’s export-dependent economy, which is already struggling with sluggish growth and a deepening political crisis. The U.S remains the largest export market for both the EU and Germany, with top exports including pharmaceuticals, machinery, and automobiles. During his campaign, President-elect Trump pledged to impose a 60% tariff on imports from China and 10% to 20% tariffs on other trade partners. Studies estimate that such an increase in tariffs could reduce Germany’s GDP by 1,2% to 1,4% compared to baseline projections for 2028. The EU’s export engine is under pressure, facing constraints from the loss of cheap Russian energy, slow adaptation to the electric vehicle transition, and heavy reliance on exports to China. Another risk is that China may divert more low-cost goods to Europe if a trade war with the U.S escalates. Caught between U.S - China trade tensions, Europe’s economic outlook may soon face its most significant challenge since the eurozone crisis. The EUR/USD pair is forecast to potentially decline to the 1,02 - 1,04 range in the first half of 2025.

The USD/VND interbank exchange rate rose to 25.330 at the close yesterday, driven by the USD’s gains on the global market (+0,54%) and large USD purchases during the day. The exchange rate may cool down in the latter part of this week as foreign currency inflows to the domestic market have started to increase. The target range for this week remains around 25.200, although the movement of the USD on the global market should be closely monitored.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn