Market Highlight 12.09.2024

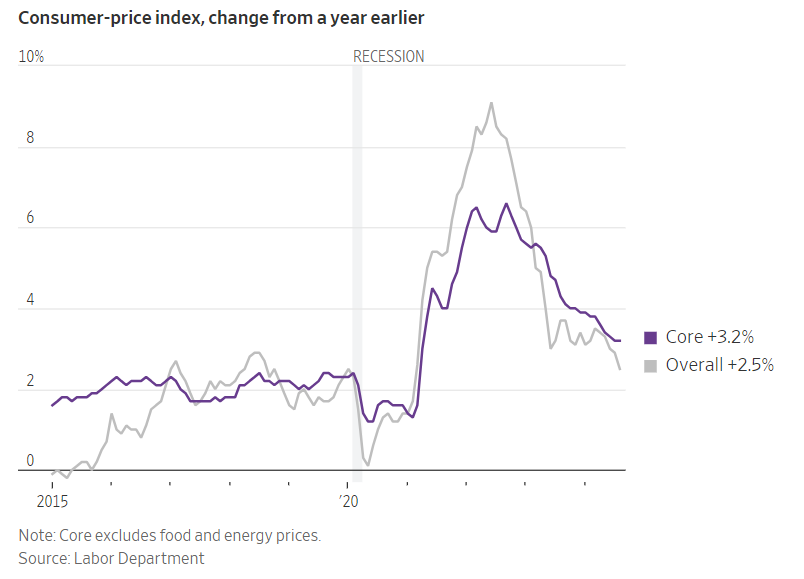

Inflation in the U.S declined in August to its lowest level in 3 years, setting the stage for the Federal Reserve to begin gradually cutting interest rates at next week’s meeting. According to the U.S Department of Labor, the Consumer Price Index (CPI) rose by 2,5% year-on-year, down from 2,9% in July, extending the cooling trend into the fifth consecutive month. Core inflation, which excludes food and energy costs, remained unchanged at 3,2%. The data released last night further reinforces the view that the FED’s focus is shifting from inflation - which has eased from a 40-year high - to a labor market showing signs of weakening, as slowing hiring raises concerns about the risk of a recession in the world’s largest economy. Higher housing costs contributed to a stronger-than-expected increase in core CPI in August, making it challenging for the FED to aggressively cut interest rates by 0,5% at its midweek meeting. The market currently sees only a 13% chance of a 0,5% rate cut in this initial reduction. However, there is still sufficient basis to believe that the FED will cut rates by about 1% over the remainder of this year, implying at least one 0,5% cut in either November or December.

The USD Index faced downward pressure, adjusting to the 101,3 level during the morning session yesterday as Democratic candidate Kamala Harris was seen to have performed better in the debate between the two U.S presidential contenders. However, the USD quickly rebounded after the U.S CPI data was released, helping it recover to 101,7 level.

Domestically, the USD/VND exchange rate fell by an additional 110 dongs yesterday, closing at 24.560 following the decline of the USD on the global market. The exchange rate is likely to see a slight recovery early today before resuming its downward trend later in the day. The target range for the USD/VND exchange rate in September is expected to be around 24.450 - 24.500.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn