Market Highlight 10.12.2025

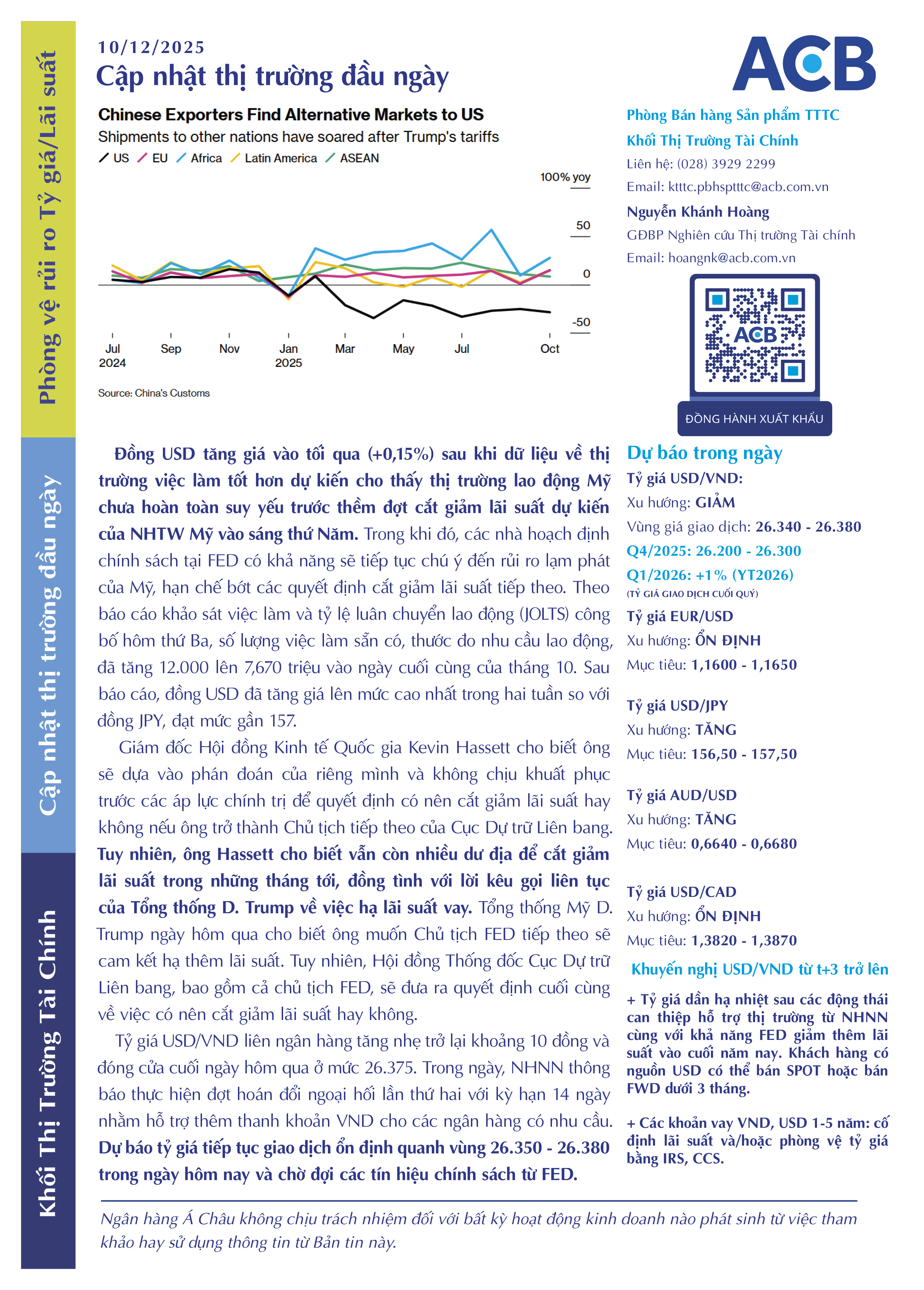

Kevin Hassett, Director of the National Economic Council, said he would rely on his own judgment and resist political pressure when deciding whether to cut interest rates if appointed as the next Chair of the Federal Reserve. However, Mr. Hassett noted that there remains “considerable room” for rate cuts in the coming months, aligning with President Donald Trump’s repeated calls for lower borrowing costs. President Trump stated on Wednesday that he wants the next FED Chair to commit to further rate reductions. Nonetheless, the Federal Reserve Board of Governors - including the Chair - will make the final decision on whether to cut interest rates.

The interbank USD/VND exchange rate edged up by roughly VND 10 on Wednesday, closing the day at 26.375. During the session, the State Bank of Vietnam announced its second round of 14-day foreign-exchange swap operations to provide additional VND liquidity to banks in need. The exchange rate is expected to continue trading steadily within the 26.350 - 26.380 range today, while markets await policy signals from the Federal Reserve.

Please contact the nearest Asia Commercial Joint Stock Bank's branch to receive information and consultancy if you are in need of making any foreign exchange and derivatives transactions.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn