Market Highlight 10.12.2024

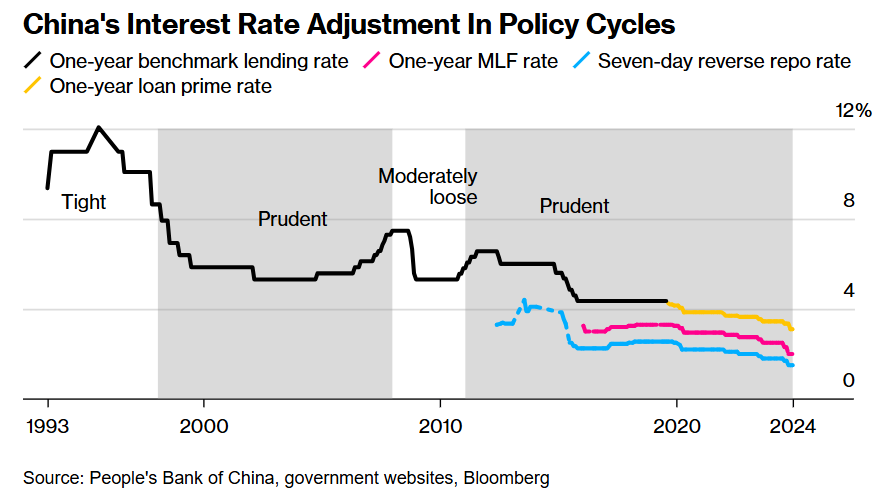

Senior Chinese leaders have signaled robust support for economic growth recovery in 2025, as the world’s second-largest economy braces for a potential trade war with the incoming administration of President Donald Trump. This commitment includes further interest rate cuts and a shift from the "prudent" monetary policy upheld for nearly 14 years to an "loose" stance. Chinese policymakers will also prioritize boosting domestic consumption in 2025 to counteract the longest deflationary period in this century. This challenge was underscored by data released yesterday, showing producer prices declined in November, marking the 26th consecutive month of contraction. Meanwhile, the consumer price index grew at its slowest pace in 5 months, hovering around 0%. After underperforming its Q2 growth target, China initiated stimulus measures in late September. Projections suggest that the People’s Bank of China (PBoC) will execute another cut to the reserve requirement ratio for the banking system before the end of 2024, with further interest rate reductions likely to follow in Q1 2025.

The USD Index edged up slightly on Monday, as markets anticipate U.S inflation data to be released later this week. Meanwhile, the AUD gained strength following China’s announcement of plans to intensify monetary easing in 2025. The European Central Bank (ECB) and Bank of Canada are expected to implement additional interest rate cuts during policy meetings this week, while the Reserve Bank of Australia (RBA) is anticipated to maintain its current interest rate policy. The USD/VND exchange rate traded within the 25.350 - 25.400 range yesterday and closed with a slight decline of approximately 15 VND. The downward trend in the exchange rate is expected to persist today, remaining near the 25.350 level.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn