Market Highlight 10.01.2025

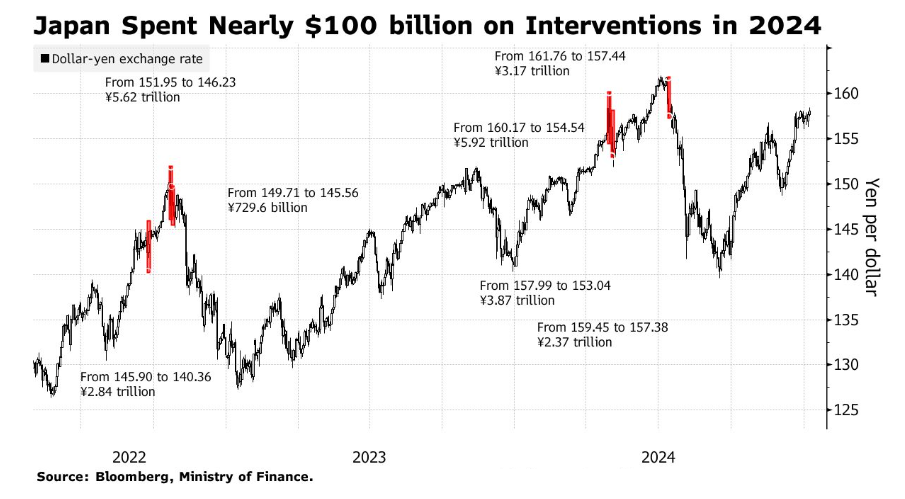

The USD/JPY exchange rate dipped by 0,15% yesterday but has still logged a gain of over 0,5% so far this week, trading at approximately $158 earlier this morning. The yen reached its lowest level since July of last year $158,55 during yesterday’s session and appears poised to test the 160 mark. The JPY’s sustained weakness against the dollar over the past 4 years stems largely from the significant disparity in interest rates between Japan and the United States. While Federal Reserve policymakers have signaled a slower pace of U.S rate cuts this year, the timing of a potential Bank of Japan (BOJ) rate increase remains uncertain. The currency pair could push back toward $160 following the release of December U.S nonfarm payroll data at the end of this week, providing further support for the USD as President Donald Trump’s inauguration date approaches. Japan expended some USD 100 billion on currency market interventions in 2024 to stem the yen’s depreciation, acting twice when USD/JPY surpassed $160. A similar response from Japanese authorities cannot be ruled out if the exchange rate threatens to breach $160 again, especially given recent warnings from key government officials. A weaker JPY could also spur the BOJ to raise its policy rates sooner rather than later. The market currently prices in a 40% likelihood that the BOJ will increase rates at its upcoming January 23 - 24 meeting.

The USD Index rose for a third consecutive day (+0,14%), supported by market expectations ahead of the U.S nonfarm payroll report for December, due tonight. Domestically, the USD/VND interbank exchange rate remained stable below 25.400 yesterday. Given renewed VND demand on the interbank market in the run-up to the Lunar New Year, the rate could feasibly slide below 25,350 in the near term.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn