Market Highlight 09.09.2024

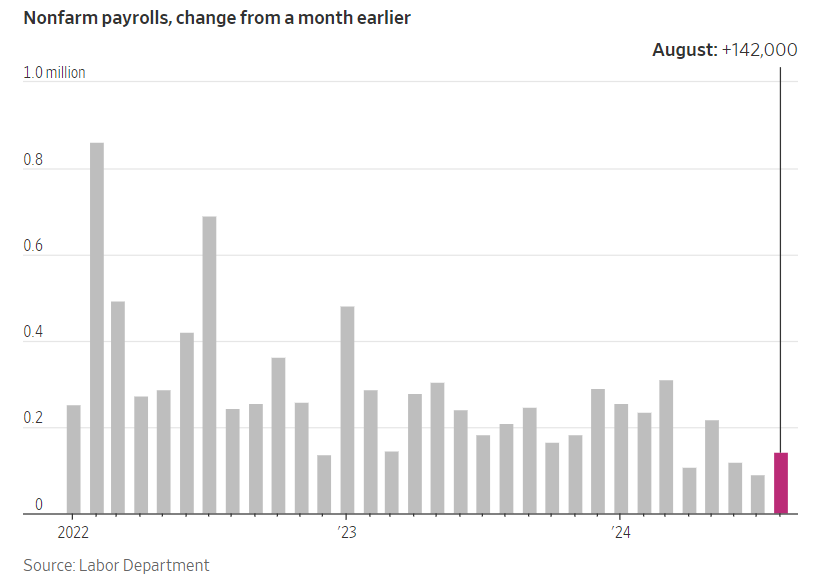

The most significant economic data from the past week indicates that hiring activity in the U.S economy remained weak in August, despite showing some recovery compared to the previous month. According to the U.S Department of Labor, the economy added 142.000 jobs, an increase from July’s figures, which had previously sent shockwaves through global financial markets due to fears of a recession. The unemployment rate in August fell to 4,2%. The statistical agency also revised down its estimates for job growth in June and July to 86.000 jobs. This further bolsters the likelihood that the Federal Reserve will begin cutting interest rates in the middle of next week, though it leaves unanswered the question of whether the first policy easing will start with a 0,5% or 0,25% cut. Although the U.S labor market has weakened considerably over the 3 summer months, it has not deteriorated enough for the FED to aggressively cut rates by 0,5%. The lack of clear policy guidance at this time led to a sharp decline in major stock indices, with the S&P 500 falling 1,73% and the NASDAQ dropping 2,55%. The USD Index, which initially fell nearly 0,5% against major currencies following the release of the employment data, quickly recovered and rose (+0,13%) by the end of Friday’s session as the market lowered expectations for a 0.5% rate cut by the FED.

Domestically, the USD/VND interbank exchange rate continued its sharp decline, dropping another 125 dongs on Friday to close at 24.620. Over the past week, despite only 3 trading days, the exchange rate fell by approximately 250 dongs (down 1%) and is now up only about 1,4% compared to the beginning of the year (24.260). The exchange rate is forecast to remain around the 24.600 - 24.700 range at the start of the week, but the downward adjustment trend may not yet be over, as the USD is expected to face significant pressure from the U.S August CPI report due on Wednesday night and the FED’s policy meeting in the middle of next week.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn