Market Highlight 09.07.2024

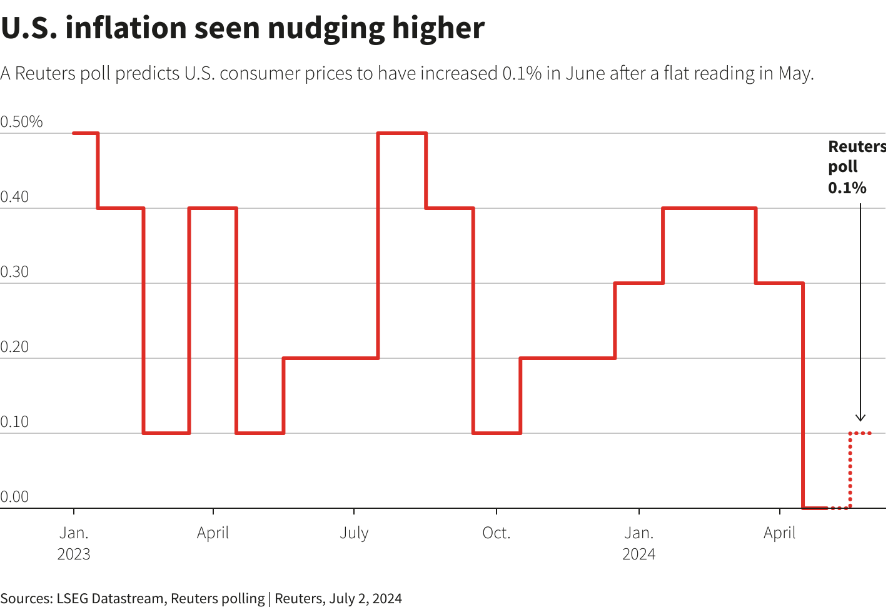

The USD Index recovered slightly by 0,1% on Monday which supported by the weakening of the EUR following the French parliamentary election results. The two-day testimony of the FED Chair before the U.S. Congress starting tonight is not expected to bring new signals regarding monetary policy before the June inflation data is released at the end of this week. A report by the New York FED shows that consumer inflation expectations in the U.S. decreased for the second consecutive month in June, thanks to expectations that housing prices and various goods prices will continue to fall in the coming year. The market currently estimates about a 20% chance that the FED might cut interest rates by 0,25% at the end of July and an 80% chance in the September meeting.

According to the latest report from the Ministry of Industry and Trade, along with the global market recovering, increased export orders have helped Vietnam's total export and import turnover in the first half of the year reach an estimated 368,53 Billion USD, up 15,7% compared to the same period last year. Seasonally, consumer demand will enter a peak period both domestically and globally towards the end of the year. Vietnam is benefiting from the shift of orders from the U.S. and has significant advantages in boosting exports to the Chinese market. The free trade agreements (FTAs) that Vietnam has signed are also providing substantial trade advantages. If export-import growth maintains its current pace, the country’s total trade value could reach the highest number of 750 Billion USD in 2024.

The USD/VND interbank exchange rate rose back to 25.420 yesterday which supported by demand from some USD payment sources. Trading sentiment in the market is quite cautious given the latest developments of the USD on the global market and the recent increase in VND interest rates on the interbank market.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn