Market Highlight 08.10.2025

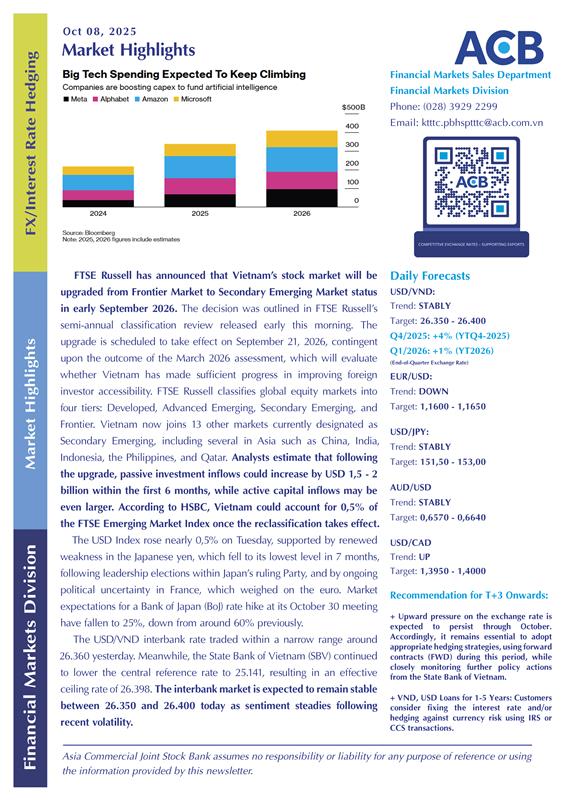

FTSE Russell has announced that Vietnam’s stock market will be upgraded from Frontier Market to Secondary Emerging Market status in early September 2026. The decision was outlined in FTSE Russell’s semi-annual classification review released early this morning. The upgrade is scheduled to take effect on September 21, 2026, contingent upon the outcome of the March 2026 assessment, which will evaluate whether Vietnam has made sufficient progress in improving foreign investor accessibility. FTSE Russell classifies global equity markets into four tiers: Developed, Advanced Emerging, Secondary Emerging, and Frontier. Vietnam now joins 13 other markets currently designated as Secondary Emerging, including several in Asia such as China, India, Indonesia, the Philippines, and Qatar. Analysts estimate that following the upgrade, passive investment inflows could increase by USD 1,5 - 2 billion within the first 6 months, while active capital inflows may be even larger. According to HSBC, Vietnam could account for 0,5% of the FTSE Emerging Market Index once the reclassification takes effect.

The USD Index rose nearly 0,5% on Tuesday, supported by renewed weakness in the Japanese yen, which fell to its lowest level in 7 months, following leadership elections within Japan’s ruling Party, and by ongoing political uncertainty in France, which weighed on the euro. Market expectations for a Bank of Japan (BoJ) rate hike at its October 30 meeting have fallen to 25%, down from around 60% previously.

The USD/VND interbank rate traded within a narrow range around 26.360 yesterday. Meanwhile, the State Bank of Vietnam (SBV) continued to lower the central reference rate to 25.141, resulting in an effective ceiling rate of 26.398. The interbank market is expected to remain stable between 26.350 and 26.400 today as sentiment steadies following recent volatility.

Please contact the nearest Asia Commercial Joint Stock Bank's branch to receive information and consultancy if you are in need of making any foreign exchange and derivatives transactions.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn