Market Highlight 03.10.2025

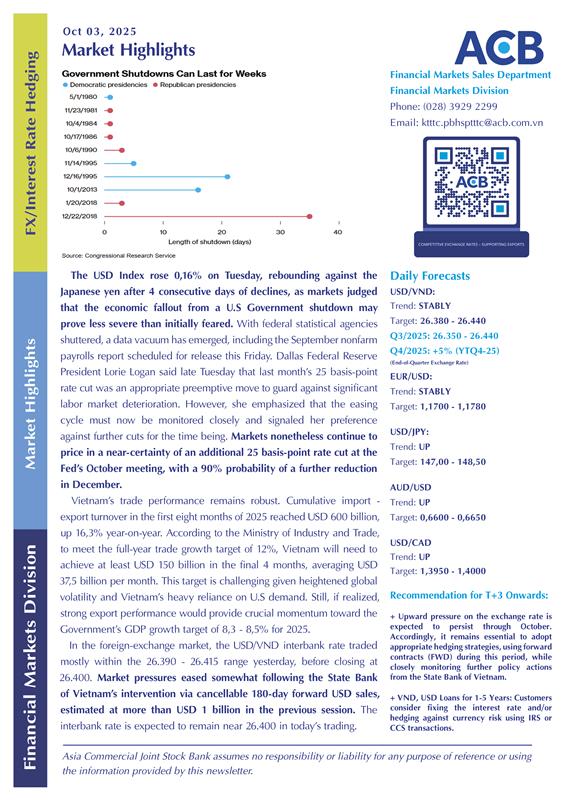

The USD Index rose 0,16% on Tuesday, rebounding against the Japanese yen after 4 consecutive days of declines, as markets judged that the economic fallout from a U.S Government shutdown may prove less severe than initially feared. With federal statistical agencies shuttered, a data vacuum has emerged, including the September nonfarm payrolls report scheduled for release this Friday. Dallas Federal Reserve President Lorie Logan said late Tuesday that last month’s 25 basis-point rate cut was an appropriate preemptive move to guard against significant labor market deterioration. However, she emphasized that the easing cycle must now be monitored closely and signaled her preference against further cuts for the time being. Markets nonetheless continue to price in a near-certainty of an additional 25 basis-point rate cut at the Fed’s October meeting, with a 90% probability of a further reduction in December.

Vietnam’s trade performance remains robust. Cumulative import - export turnover in the first eight months of 2025 reached USD 600 billion, up 16,3% year-on-year. According to the Ministry of Industry and Trade, to meet the full-year trade growth target of 12%, Vietnam will need to achieve at least USD 150 billion in the final 4 months, averaging USD 37,5 billion per month. This target is challenging given heightened global volatility and Vietnam’s heavy reliance on U.S demand. Still, if realized, strong export performance would provide crucial momentum toward the Government’s GDP growth target of 8,3 - 8,5% for 2025.

In the foreign-exchange market, the USD/VND interbank rate traded mostly within the 26.390 - 26.415 range yesterday, before closing at 26.400. Market pressures eased somewhat following the State Bank of Vietnam’s intervention via cancellable 180-day forward USD sales, estimated at more than USD 1 billion in the previous session. The interbank rate is expected to remain near 26.400 in today’s trading.

Please contact the nearest Asia Commercial Joint Stock Bank's branch to receive information and consultancy if you are in need of making any foreign exchange and derivatives transactions.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn