Market Highlight 03.10.2024

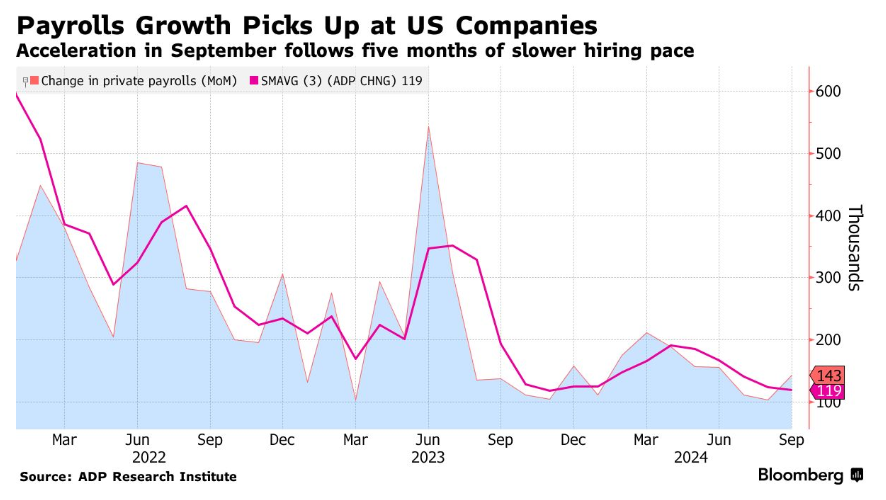

The USD Index recorded its third consecutive day of gains, reaching a three-week high against the EUR. By the close of yesterday’s session, the index stood at 101,6 points after U.S private sector employment data for September exceeded expectations, ahead of the critical nonfarm payroll report set to be released this Friday. According to the ADP Research Institute, U.S private payrolls increased by 143.000 last month, the lowest since March 2023, but still above the forecast of 125.000 jobs. Improved economic data from the U.S and recent comments from Federal Reserve Chairman Jerome Powell have bolstered the USD, reducing market expectations for a 0,5% rate cut at the next FED meeting. Meanwhile, there are no signs of de-escalation in the Middle East, with tensions between Israel and Iran potentially escalating in the coming days, further reinforcing the USD’s role as a safe-haven asset. Currently, the market predicts only a 35% chance of a 0,5% rate cut by the FED at its November 6-7 meeting, down from nearly 60% the previous week. The U.S services PMI data, due tonight, will provide further insight into the current health of the world’s largest economy.

The USD/VND exchange rate rose by approximately 60 VND yesterday, closing at 24.670, with the upward momentum sustained throughout the trading session. Since the start of the week, the interbank rate has increased by about 0,25%, primarily supported by the global recovery of the USD (+1,27%) and ongoing foreign currency demand at the beginning of October. The USD/VND exchange rate is expected to continue its upward trend toward 24.700 today, with the potential to challenge the 24.800 level later this month.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn