Market Highlight 03.03.2025

The USD edged lower last Friday evening after U.S PCE data slowed as expected, while consumer spending unexpectedly declined. Specifically, the Personal Consumption Expenditures (PCE) Price Index rose 0,3% in January, following a 0,3% increase in December. On a year-over-year basis, PCE increased 2,5%, compared to 2,6% in December. However, consumer spending, which accounts for more than two-thirds of U.S economic activity, fell 0,2% last month after rising 0,8% in December. The USD Index recovered by the end of the last trading session of February, closing with a 0,23% gain at 107.61. Over the past week, the USD strengthened by approximately 0,9%, but it posted a 0,8% monthly decline in February, marking the largest monthly drop since September 2024. Market expectations for a 0,25% rate cut by the Federal Reserve in its June meeting have risen following the release of U.S inflation and consumption data, with an 80% probability of a rate cut, up from 70% the previous day.

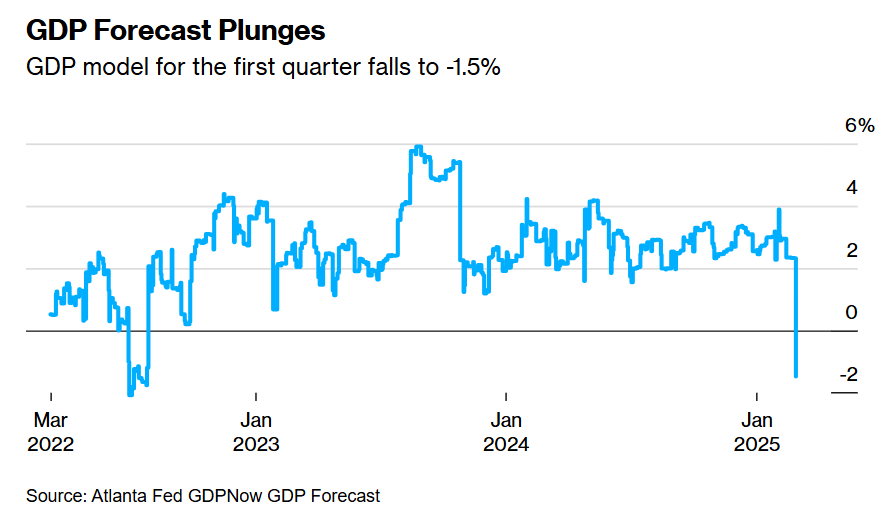

The world’s largest economy faces increasing growth risks in Q1 2025, as reports indicate weaker consumer spending and a significant widening of the trade deficit (+25%) in January. According to estimates from the Atlanta Fed, U.S GDP is projected to contract by -1,5% in Q1, a sharp slowdown from the +2,3% growth forecast just days earlier. If U.S economic data for February and March continue to deteriorate, Q1 GDP could turn even more negative than the current projection.

The USD/VND interbank exchange rate closed the final trading day of February at 25.550, as the market lacked clear drivers, despite the USD’s rebound last week. The possibility of escalating global trade tensions ahead of tomorrow’s (March 4) tariff deadline remains a key factor to watch this week. The exchange rate is expected to continue trading within the 25.500 - 25.600 range in the first trading session of the week.

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn