Market Highlight 01.07.2024

The USD Index adjusted down for the second consecutive day last weekend but still recorded a nearly 1,2% increase since the beginning of June. The market continues to look for signals on when the FED might cut rates, with many important economic data and events happening this week. First, the U.S. non-farm payroll report for June on Friday and the FED Chairman's speech on "Monetary Policy in Transition" at the ECB's annual forum on Tuesday will be the market's focal points. Additionally, developments in parliamentary elections in France and the U.K, along with inflation data from the Eurozone, will significantly impact the EUR trend in July.

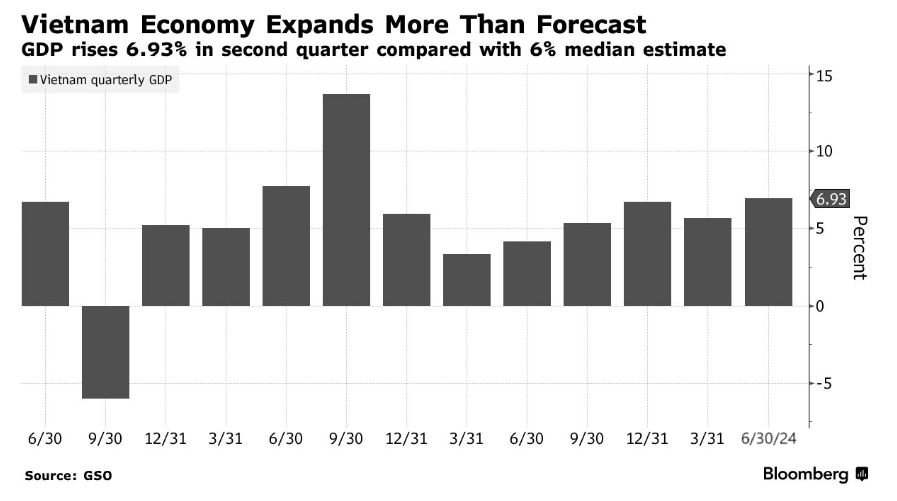

The USD/VND interbank exchange rate slightly decreased for the second consecutive day last Friday to below 25.450. This is expected to remain the main market price range this week, although trading sentiment improved after Vietnam's Q2 GDP data came in higher than forecast (up 6,93% compared to the same period last year).

Asia Commercial Joint Stock Bank assumes no responsibility or liability for any purpose of reference or using the information provided by this newsletter.

Directly contact us to receive market news and consultancy on foreign exchange products and derivatives:

- Financial Markets Division – Email: ktttc@acb.com.vn ; or

- Mr. Khanh Hoang (Financial Markets Senior Analyst) – Email: hoangnk@acb.com.vn